Today’s Agenda

- NFTs

- Symbiosis

- Web 2 vs. Web 3

- Inherent Value

- NFTs & DeFi

- DAOs

- Token Governance

- Case Studies

- Effectiveness

- The Skeuomorphic Argument

NFTs

An NFT is a non-fungible token worth some amount of (a) fungible token(s). NFTs are complicated, wide-ranging, and severely misunderstood regarding their potential. They’re traded on-chain, so NFT markets are open 24/7. While most of what you regard as an NFT will likely be worthless in due time, there can be massive amounts of inherent value when designed with utility in mind. NFTs can represent both digital and real-life objects.

Owning an NFT worth $10,000 can be much more powerful than holding $10,000, but it is not easy to explain why if you need help understanding how blockchains work. NFTs can represent basically anything, such as the ownership of a real-world asset, music royalties, socks, art, in-game items, and even sophisticated DeFi mechanisms. Anyone with an NFT can be airdropped future tokens and NFTs. NFTs can give you special access to a concert or any live event. They can be static profile photos, they can be generative gifs, and they can even be the deed to your house. The opportunities are virtually and physically limitless.

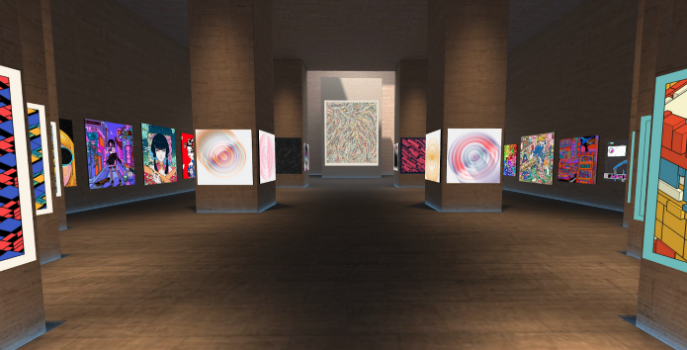

Think of the NFTs you own as the digital version of your belongings on display in your house. Art on the walls, a collection of your favorite artists’ CDs, posters of memorable past events, etc. Instead of this collection of belongings’ visibility being limited to visitors in your home, anyone can view your digital NFT gallery to get a sense of your interests, hobbies, and cherished items.

Like Vincent Van Dough’s multi-million dollar virtual studio below, you can also make customized 3D and VR-accessible museums for your collections.

Symbiosis

When an investor buys an NFT, the NFT is automatically deposited into their wallet, and depending on the exchange, the funds should be automatically deposited into a creator’s wallet.

The investor is buying the NFT because they see value in holding it. This permission-less value transfer from creators to investors is not one way. Creators get to set a royalty rate on their NFTs, which often ranges from 1-5%. If the rate were 5%, then the NFT creator would automatically receive 5% of every secondary sale. No ifs, and, or buts. The code behind the autonomous smart contracts involved is in charge. It’s a bit different than Apple’s 30% take rate on every sale of anything within the app store.

This capability was impossible a decade ago, and it is a game-changer for creator economies like video games, digital art, music, and film.

Think about the ramifications for an incumbent industry with any form of cash flow. Royalties generated from an NFT project can be funneled into a community treasury governed by a DAO of people who own the NFTs from said project.

How do you gain access to the DAO? Own an NFT from the project.

Web 2 vs Web 3

Web 2 is a term that refers to the state and function of the world wide web from the year 2004 or so to the present day. In short, it is a mentality and framework for how the internet should evolve. A full description of web 3 is out of the scope of this course but feel free to check out the articles breaking down Web 1, Web 2, and Web 3 on Solflare’s Knowledge Base.

Many conventional web 2 creators and engineers have a significant amount of vitriol for what’s being called web 3. Web 3 has become quite the buzzword, although it’s simply a function and philosophy for how the open internet should operate. It’s closer to the vision that early internet developers had when compared to what the internet has turned out to be – a few walled gardens full of user-generated content. Web 3’s ideal framework is user-owned networks. Regarding the creator economy, the new multi-chain toolset that is beginning to enable user-owned networks is surreally underrated in the mainstream.

Sure, you can make a 2+ hour-long YouTube video describing what you think is wrong with how people choose to use NFTs, or you can embrace the new toolset, foster a hybrid community of fans and investors around you, and generate a hybrid assembly of fans and investors peer-to-peer income streams that have never existed before. There’s an expanding list of platforms facilitating this newfound value creation; some of the best are Mirror, Sound, Catalog, Glass, Pianity, Audius, Nina, and all the high-quality NFT exchanges out there. Also loft.radio.

If someone is talking down on NFTs, they probably don’t understand them.

If you’re still skeptical, contact any artist on any of the platforms listed above and have them compare their Web 3 experience to their Web 2 experience.

Inherent Value

NFTs are not only subject to creator economies. They can operate in any industry.

Imagine an NFT framework for a residential investment property, an ice cream store, or a Bruno Mars song. Any cash flow can be tokenized, fractionalized, and distributed via NFTs. It’s similar to horse syndication in professional horse racing, but it can be applied to nearly any asset class.

NFTs are poised to flip the creator economy on its head by giving individuals access to innovative community and fundraising opportunities while doing so in this new permission-less world of DeFi, NFTs, and DAOs.

Rather than build user-generated content gated behind centralized networks like Twitter or Facebook, Web 3 proponents seek to build user-owned networks that empower individuals and lessen barriers to entry for many industries.

NFT & DeFi Money Legos

NFTs coexist in your digital wallet alongside your cryptocurrency.

NFTs are just tokens.

Tokens are programmable.

DeFi is interoperable.

NFTs can be used as collateral for lending and borrowing, or they can be tools within the complex network of cross-chain DeFi protocols. Think of all these machinations as if they were each different legos. Many DeFi developers refer to what they do as building money legos which may help you visualize how it works.

Alongside using them as collateral, NFTs themselves can be fractionalized.

Fractionalized.io is an exchange where users can choose how much of an NFT they want to sell and for what price. The impact fractionalization has on NFT-gated DAOs is determinable on a case-by-case basis.

Just for fun

There is even a project where a photo of the Shiba Inu dog was turned into an NFT, fractionalized, and used as collateral backing a new cryptocurrency: DOG.

OK, now on to DAOs.

DAOs

DAOs have been around for quite some time. They stand for Decentralized Autonomous Organizations and are a de facto standard for how many crypto protocols operate.

The first DAO references began popping up in the early 90s, although they only became a reality in the mid-2010s. In the early days of Bitcoin, crypto enthusiasts would attempt to build proto-DAOs called DACs – Decentralized Autonomous Corporations. These DACs slowly evaporated as there was no sustainable platform for them to operate on in the way the enthusiasts envisioned. Once Ethereum was live, DAOs emerged. The early formations of DACs and DAOs strongly believed that code is the law.

Although that sentiment has since diminished because of the abundantly clear fact that code is fallible, the belief still permeates through operational procedures within DAOs as most activity occurs on-chain or through a series of smart contracts.

Above is a screenshot of DeepDAO’s analytical dashboard breaking down recent DAO statistics. With over 4,000 organizations, $10 billion across treasuries, and 1.8 million unique governance token holders, DAOs look like they’re here to stay.

Token Governance

Tokens, fungible or non-fungible, represent ownership.

Web 3 is based on the idea of user-owned networks.

Ownership implies governance.

Want to join a DAO? Buy or earn the token.

Case Study

If you transact on Uniswap, Ethereum’s largest DEX, you pay the transaction fee in ETH. So what’s the UNI token for? The short answer is governance. The Uniswap protocol earns fees automatically deposited into a treasury which is then governed by UNI holders via components of the smart contracts involved. There are no intermediaries escrowing funds or charging excessive fees.

It is simply people interacting with a decentralized protocol on a decentralized blockchain.

Recently, Uniswap’s trading volume eclipsed that of Coinbase. Due to smart contract programming, a portion of all the transaction fees is automatically deposited into the Uniswap Treasury wallet. This treasury now holds over $2,600,000,000 at current prices.

Who decides what is done with this money?

UNI holders. UNI holders vote on proposals for what is done with the treasury. 1 UNI = 1 vote.

There are issues with this model, such as the idea that a rich person or company could come in and buy all the tokens to domineer governance decisions. Many alternative models are constantly being iterated on, so if you don’t like the DAO you’re in, join another one.

Effectiveness

On-chain governance is a field that has really taken off in the past few years. You’ll see the letters D A O imprinted all over the place, and sometimes it makes more sense than others.

The effectiveness of DAOs is up for debate on the whole. However, there are numerous examples of successful implementations and people making a living in the pseudonymous economy by contributing to one or more DAOs from an anon account. An anonymous account is technically a pseudonymous account where someone communicates with the DAO as an unknown entity.

Legal Ramifications

Legal ramifications also need to be considered, especially when a DAO is built around investing – such as a decentralized venture capital firm, StackerVentures. This field of law is highly murky, and pioneers are still figuring out how things will work. The US state of Wyoming has instituted DAOs as a variation of the traditional LLC framework that companies follow, but it is still early in the game.

If you’re a lawyer, you should learn about crypto. Thank me later.

Lessening Barriers to Digital Democracy

The long-term purposes of DAOs are to decrease the amount of control an entity has within an organization. It’s a natural extension of Democracy, but its effectiveness varies from DAO to DAO.

Forming an online community (DAO) and building a treasury (coins, tokens, NFTs) that the community can govern has always been challenging. This has resulted in many spectacular projects across the world.

The Skeuomorphic Argument

Skeuomorphism refers to the idea of doing something that is obsolete but in a new context. It has been used at great length to discuss issues with DeFi and Web3.

Token-based governance is a reasonably skeuomorphic concept because TradFi systems already enable corporate governance via share ownership. The difference that DAOs offer is these tokens exist on-chain in an inherently composable and transparent nature compared to TradFi, where equity shares have many inhibiting features, and significant decisions are made behind closed doors.

This concept of composability means that these tokens can be utilized in many shapes and sizes, such as a form of voting rights in a DAO or collateral in a DeFi project. Some votes are worth more than others, and token-gated DAOs constantly evolve. You can even send on-chain bribes. Say you wanted to influence the decision of a UNI whale. Well, you could send over some ETH or USDC and try to convince them. This opens a discussion of tokenomics that we won’t get into here but know that a lot is going on out there.

The topic of composability has become the backbone of much of the DeFi, NFT, and DAO worlds.

Finally

As you can see, there really is a crypto renaissance happening. What started as a few computer protocols around money has blossomed into a wide-ranging world of opportunity revolving around cutting-edge technology, cryptography, finance, gaming, art, publishing, self-sovereignty, digital transparency, and more. It’s hard to imagine an industry that is exempt from what is happening in crypto.

Just remember:

- NFTs and DAOs are logical extensions of DeFi.

- DeFi is a logical result of decentralized networks.

- Decentralized networks exist because of Consensus Methods.

Congratulations, you now have a fundamental understanding of how it all works. 🥂

Check out the last chapter, a glossary of all the concepts we covered, and some further reading links.