What is SOL Staking?

SOL Staking is the process where SOL holders delegate a defined amount of their SOL to a validator, or set of validators, in return for monetary rewards in the form of more SOL.

This secures the Solana blockchain by empowering the decentralized network of validators who validate transactions through consensus mechanisms. They are required to have been delegated a certain number of SOL, and their likelihood to validate a block of transactions increases as more SOL is delegated to them. They also earn more rewards for having more SOL entrusted to them.

It’s important to understand that delegating SOL tokens to a validator does not give the validator control of your tokens. Instead, it verifies the validator as a trustworthy network participant worthy of validating transactions. This is the essence of a Proof of Stake network like Solana.

Proof of Stake (PoS) & Proof of History (PoH)

The Solana blockchain operates as a hybrid of a Proof of Stake (PoS) & Proof of History (PoH) network.

Proof of History is a revolutionary innovation regarding how the Solana blockchain handles time. Proof of Stake is a framework in which blockchain infrastructures validate transactions on the network. These frameworks are referred to as consensus algorithms because they allow different nodes responsible for validating network activity (“miners” or “validators”) to agree on a recent group of transactions before they’re confirmed and executed.

Proof of Stake is a more energy efficient, cheaper, and faster alternative to the traditional Proof of Work (PoW) networks that Bitcoin and Ethereum previously used. There are heated debates over which framework is more secure, but there is no doubt that Proof of Stake works. It enables faster transaction speeds and lower transaction fees, which may not be the purpose of a Proof of Work network.

Bitcoin began as a peer-to-peer value transfer mechanism. It’s clearly stated in the Bitcoin White Paper that that’s what the intention was. It’s even in the title. As global monetary policy has shifted over the last decade, so have the revolving narratives around Bitcoin. Rather than being treated as an exchange mechanism, many investors have begun theorizing it as an immutable store of value, similar to gold and other precious metals.

What Bitcoin is depends on who you ask, but when it comes to being a store of value, believers of the Proof of Work consensus method will claim that Proof of Work is the only way to truly determine a digital asset’s value in a decentralized manner. Solana, on the other hand, is not meant to be a store of value but rather an ambitious network for fast and cheap transactions – according to the company’s CEO.

Some benefits of Proof of Stake

- Less energy consumption by validators when compared to miners (PoW).

- This is simply due to the computing power required to secure a PoS network being far less than a PoW network.

- Less risky in terms of the potential for miners or validators to attack the network.

- Validators would need 51% of the staked SOL delegated to them, and at that point, it would not be in the validators’ best interest to attack the network.

- Regarding Proof of Work mining, particularly on the Bitcoin blockchain, one day, miners will need to deal with the Tragedy of the Commons dilemma, which doesn’t exist in Proof of Stake networks.

- Scalable transaction speeds & fees.

- The Solana network can easily facilitate 65,000 transactions per second (tps), while the Bitcoin network can execute 5-10 tps.

- Solana’s fee structure is roughly 1 million transactions per $10 fee.

- In simulations, Solana has amassed 400,000 tps, and its theoretical limit is 700,000.

- To put that into perspective, Visa and Mastercard’s peak tps is around 50,000 during Christmas.

Why Stake my SOL?

If you don’t intend on selling it, you might as well earn a yield on it.

Delegating your SOL to the decentralized network of validators doesn’t only help secure the network and rewards you with more SOL. Using the Solflare wallet’s built-in staking capabilities, you can earn ~7.25% annually in staking rewards with your SOL.

Decentralized, permissionless networks like Solana need to operate with incentives. No central intermediary is making sure everything goes smoothly. If you weren’t incentivized to delegate, then there would be no reason to do so – similar to the fact that validators would have no reason to spend energy and computing power to validate transactions if they had no monetary incentive.

Choosing a Validator

Before staking, it would be best to consider which validator you want to delegate your SOL to. The essence of crypto is decentralization, and each blockchain network has its tradeoffs.

To ensure that the Solana network stays adequately decentralized, you want a diverse pool of validators to validate the transactions. Validators are more likely to be chosen to validate blocks of transactions when they have more SOL delegated to them – that delegation signals trust in the validator doing its job.

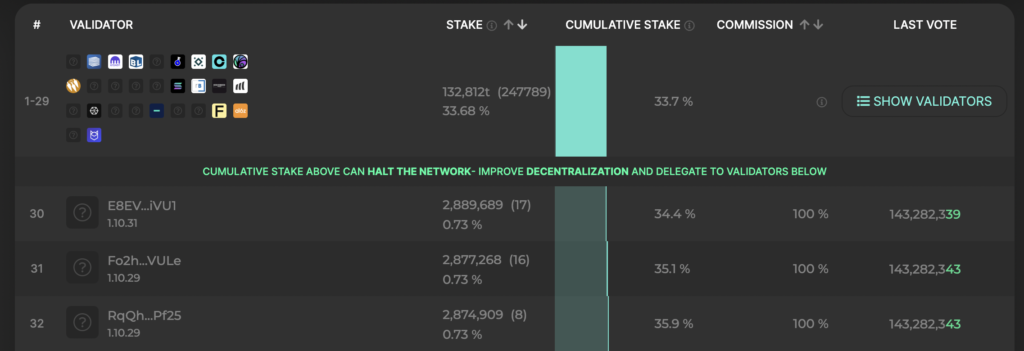

As you can see in the image below, the top 20 validators currently account for 34.18% of all staked SOL. Delegating to a validator that is not included in the top 20 contributes to the network’s decentralization.

Warm-up & Cool-down Periods

One thing to consider about your staked SOL is the warm-up period for delegations.

During this time, a specified portion of your stake is considered ‘effective’ while the remaining balance is ‘activating.’ The amount of staked SOL deemed immediately effective is determined by the total effective stake of the last epoch. The time periods that the Solana blockchain works with are called epochs, which refers to the number of slots for which a leadership schedule is valid.

There’s also a cool-down period, the reverse process that eventually enables you to withdraw your whole stake.

In other words, you may have to wait a short time before your full stake is considered effective, which enables you to earn SOL rewards for the entire stake.

Risks to Staking SOL

To discourage the delegation of SOL to bad actors, validators who perform malicious actions are punished by having their delegated SOL slashed. Slashed SOL is unrecoverable. This is yet another incentive built into the Solana network to help secure it.

A validator with slashed SOL means that that validator will accrue fewer rewards and be less likely to be chosen as the validator of a given block. Not only are there monetary losses for having slashed tokens, but there is reputational damage. Stakers will not want to delegate to bad actors because they don’t want their SOL slashed for reasons outside their control.

As you can see, there is a delicate network of incentives that serves as the driving function and security of the Solana network. Staking is an integral part of that.

Check out this guide for more information on how to stake your SOL tokens using the Solflare wallet. If you still need to make a Solflare wallet, this guide will show you how to get started.