Unbanked to Bankless

The majority of the world has at least one bank account but there are millions of people who don’t. Being unbanked or underbanked can be very destabilizing as you have to safeguard or carry your assets with you at all times and pay for everything in cash. As blockchain technology has developed, it’s enabled anyone to generate a non-custodial wallet which is effectively a decentralized bank and investment account, eliminating the need for you to trust an intermediary to safeguard and give you access to your funds.

No one can close your blockchain account and no one has access to your funds other than you. You are essentially bankless but you do need to configure on and off-boarding methods which may require a bank. Non-custodial wallets are being used all over the world and many of the unbanked are opting to go bankless.

Banking, while a covetable aspect of a developed society, has its issues. This article breaks a few of them down and gets into the problems of being unbanked and the promise of going bankless.

Today’s Agenda

- The Unbanked

- Issues with Banking

- Trustworthiness

- Fractional Reserve Lending

- Systemic Risk

- Bad Behavior

- Going Bankless

The Unbanked

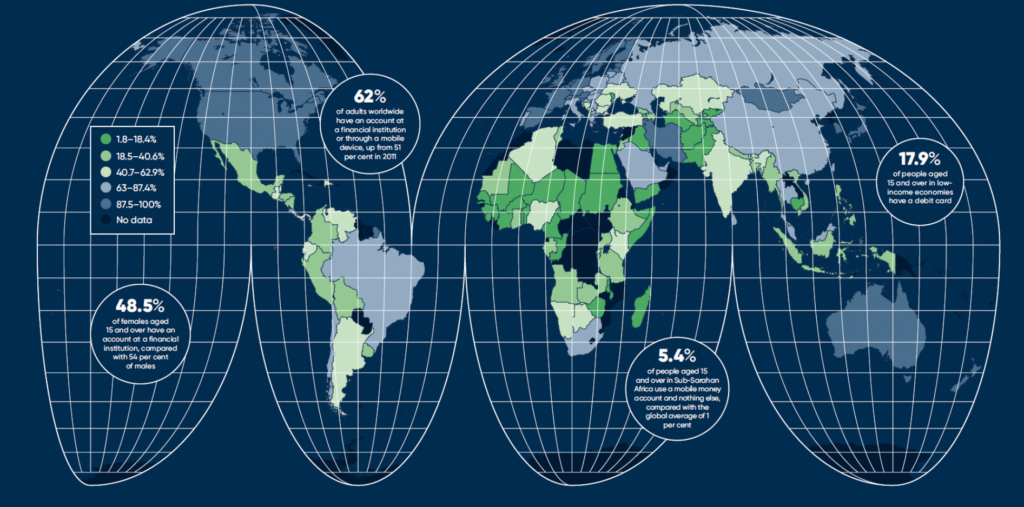

The population of unbanked citizens varies widely across the globe from roughly 0% in countries like Norway and Sweden to over 70% in Morocco. Reasons also vary but the primary causes are a lack of trustworthiness in domestic banking institutions and excess poverty. Financially stable countries are generally more banked, however, the US, the “richest” country in the world, had 22% of its adults unbanked or underbanked in 2019. That’s 63 million people.

Anyone who is unbanked is not able to partake in earning interest on deposits, investing in the stock market, paying bills online, purchasing goods or services over the internet, accessing credit, or a number of other valuable financial activities. There is also the need to use alternative financial services like money orders and prepaid cards which are inefficient and rack up fees. According to Forbes, “unbanked and underbanked Americans spent $189 billion in fees and interest on financial products in 2018”.

While banking isn’t a perfect system, there’s no doubt that using a good one gives an individual more financial freedom and ability when compared to being unbanked. The problem is, that not all banks are good ones.

Issues with Banking

Trustworthiness

Trustworthy bank accounts are a luxury in many parts of the world. Even more so in the US where most bank accounts are FDIC insured for up to $250,000. If you deposit $250,000 into an FDIC-insured bank account, you can be certain that your money is backed by the full faith and credit of the US government, its military, and its money printer.

Non-US bank accounts are generally trustworthy although developing countries with their own currencies often experience volatility in regards to purchasing power. This, along with internal political and external geopolitical pressures weighing into the equation, can result in what’s known as a bank run where everybody tries to withdraw their money at or around the same time. Well, due to the global practice of fractional-reserve lending, banks are not holding onto everyone’s money at the same time.

They are lending it out with interest to make money on your money.

Fractional Reserve Lending

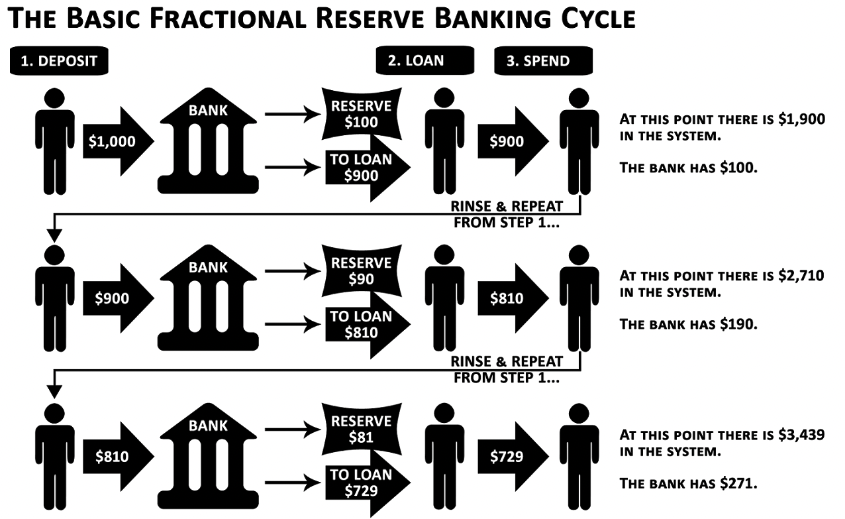

When you deposit money into a traditional checking account at a bank, you’ll likely be charged a fee to keep your money with them and you will not earn interest on your deposit – but the bank will. All the bank has to do is ensure that a specific ratio of cash from depositors is kept on hand in case depositors want to withdraw. If this ratio, called the reserve ratio, is 10% for example, then a bank can lend out $9 out of every $10 you deposit.

When the bank loaned out your $9, they increased the amount of money in the economy by $9. 9 of your 10 dollars are now being used twice. All of a sudden, $10 is $19.

This debt that is being incurred by borrowers must be paid back – with interest. In this sense, debt is willing capital into being in order to pay off both interest and opportunity costs that the individual is taking. The theory behind fractional reserve lending is that capital creation is something that drives or forces economies to move forward.

Systemic Risk

When economies are riding high, fractional reserve lending is a bank’s superpower but problems start appearing once currencies lose their value and too many people try to withdraw their cash at the same time. The reason currency failure is a factor is that your deposits are just collateral for banks to issue loans. These loans are on behalf of your liquidity but you are not being rewarded for it – the bank is. When you take out a loan, you are borrowing some other depositor’s liquidity. US Treasuries are not much different.

Cryptocurrencies are often referred to as Ponzi schemes by skeptics and in some cases, they are correct although these skeptics usually fail to recognize how the US Treasury system works.

The US Treasury system works like this:

- The US government spends all its tax revenue and wants to borrow money to keep spending.

- The US government issues US Treasury notes, bills, and bonds in order to bring in more liquidity.

- These notes, bills, and bonds – all referred to as treasuries – are I-owe-yous that will be paid back with interest. This interest rate is what’s referred to as the risk-free rate although that name is misleading.

- Treasuries, like all forms of fixed income, are legal contracts that require buyers to be paid by a certain date.

- Previously issued US Treasuries need to be paid off with interest so the US government either uses tax revenue or issues new treasuries to pay off old debts. Usually, they issue new debt.

Now let’s look at the definition of a Ponzi-scheme on the SEC’s website.

A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors.

Moving on.

Bad Behavior

Aside from the global financial meltdown in 2008 caused by Wall Street and the banking system, banks have accumulated hundreds of billions of dollars in fines over other bad behavior.

Here’s a list of the number of fines that a few banks have paid since the year 2000.

- Bank of America (US) – $82,737,699,939 over 214 fines.

- JPMorgan Chase (US) – $35,744,240,670 over 158 fines

- Citigroup (US) – $25,450,155,764 over 122 fines

- Wells Fargo (US) – $21,340,036,745 over 181 fines

- Deutsche Bank (Germany) – $18,156,533,878 over 59 fines

- UBS (Switzerland) – $16,792,800,910 over 83 fines

- Goldman Sachs (US) – $16,365,468,987 over 44 fines

Financial services are the most fined industry in the world. Since 2000, there has been over $330,904,834,105 from over 6,000 fines.

Going Bankless

As you can see, banking has its issues. Before Bitcoin and non-custodial wallets, the only way to be your own bank was to be unbanked and as detailed earlier, that also has its issues. Bitcoin, then Ethereum, then thousands of other cryptocurrencies enabled anyone anywhere to open a private bank and investment account on a blockchain and not require the trust of any third party.

It’s counterintuitive but when it comes to financial services, you don’t want to have to trust anyone. An ideal blockchain would not require its participants to trust each other but rather serve as an operating system for applications to operate in a trustless and permissionless fashion.

Non-custodial wallets are immutable sources of record for your savings / HODL account. When you deposit money into any custodial account like a bank or centralized exchange, you are trusting this counterparty to both honor your balance and give you access to your funds. You don’t have to trust any counterparty when using a non-custodial wallet. The blockchain is collectively verifying your balance and only those with the mnemonic have access to a wallet.

This is why it’s so important to understand and safeguard your mnemonic phrase!

Conclusion

For the first time in history, individuals have the ability to self custody their own assets. Given that there are so many people who are still unbanked and so many problems with the banking system, many are jumping straight from being unbanked to going bankless.

This phenomenon is particularly evident in Africa and Southeast Asia where there are high percentages of unbanked populations and high adoption rates of blockchain technology. As more of the world’s unbanked population go bankless, these individuals will begin to take advantage of the next generation of financial services and markets.

This will have massively positive ramifications for the future.