Orca Spotlight

Orca is Solana’s most user-friendly decentralized exchange (DEX).

A DEX is a peer-to-peer marketplace where traders can swap tokens with one another in a non-custodial fashion using smart contracts. Various forms of Automated Market Makers (AMMs) facilitate the token exchange process using liquidity pools funded by liquidity providers (LPs).

With over $800 million in total value locked (TVL), Orca is the fourth largest application built on Solana and is the third most utilized DEX, right behind Raydium and Project Serum. Due to their interoperability and innovative properties, DEXes have become the primary medium for traders to transact digital assets on-chain.

This article breaks down Orca’s product offerings and gives you an idea of why it stands out amongst other DEXes.

Background

Having launched the protocol as a pseudonymous team, Orca decided to dox themselves on an episode of the Solana Podcast hosted by Solana CEO Anatoly Yakovenko. They then released a blog post entitled Meet the Team, which dove into why they went about the project this way while introducing each contributor and advisor.

Orca’s initial core team comprises Yutaro, Ori, tmoc, and Milan. Their experience includes engineering stints with UMA, Coursera, IDEO Tokyo, Google, and Ethereum, and consulting experience at McKinsey. In September, the team raised $18 million in a Series A from some of the most reputable venture firms in crypto – 3AC, Sino Global Capital, DeFiance Capital, Coinbase Ventures, Solana, and more.

Features

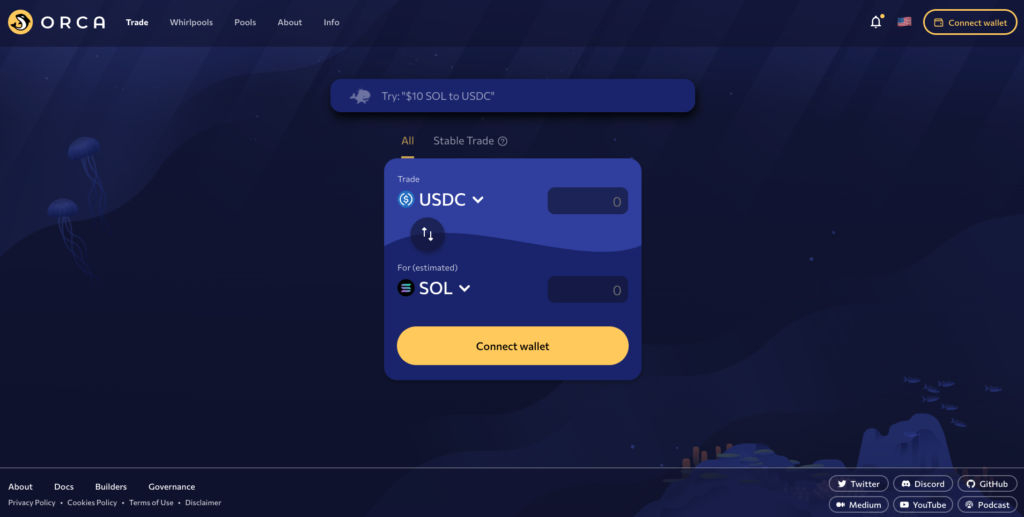

Orca offers all the bells and whistles of a typical DEX while providing a non-intimidating user interface and a seamless user experience.

Exchange

The exchange itself is presented similarly to other DEXes like Uniswap and Raydium. It allows users to see all their token balances on the left – this is more useful than it seems. Links to startup guides and documentation are also only a click away.

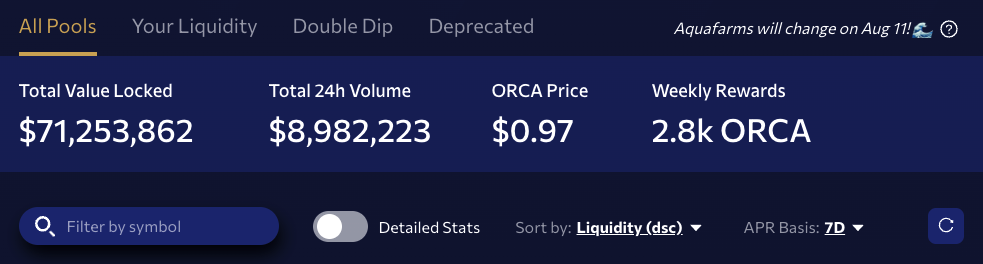

Pools

Becoming a profitable liquidity provider is easier than ever with Orca. There are multiple ways to sort through the different pools such as by their liquidity, trading volume, and APR.

This APR figure can be configured to measure returns on a retroactive basis of 7 days, 1 week, or 30 days. This gives you a realistic estimate of what you can earn based on what the pool has been actually earning.

Detailed Stats

While the stats displayed in the image above will be more than enough for most people, Orca also offers a Detailed Stats display which can be toggled on and off.

This presents users a link to the LP distribution, total LP tokens outstanding, and the compartmentalized APRs that sum to the figure listed next to each pool. The APR sources vary depending on what type of pool you are invested in.

Double Dips & Aquafarms

Standard pools are listed on the platform, although most of the liquidity pools are Aquafarms which reward liquidity providers with ORCA tokens and a share of the trading fees involved.

Double-Dip pools are Aquafarms that reward LPs with ORCA tokens, a share of the trading fees, and a partner project’s token.

Staking

At times, Orca will offer single-asset staking pools that reward stakers with a risk-free token reward. At the time of writing, there are no active staking pools, and the most recent ended on November 2nd.

Staking pools are good places to park tokens you don’t plan on selling since you might as well earn a reliable yield on them. While you can usually yield more from a liquidity pool, liquidity providers are subject to potential impermanent losses (which become permanent when LP tokens are withdrawn) due to price fluctuations.

Accessibility

Orca’s accessibility is unmatched regarding ease of use and delightful UX innovations. The UI is appealing and self-explanatory in ways that don’t dilute the app’s sophisticated backend.

Since day one, Orca’s development has been based on the user. Alleviating monotonous tasks involved in DEX trading while enhancing user experience has been the primary function of Orca protocol thus far, and there is much more on the horizon.

Below are some of Orca’s UI and UX innovations that have been met with great acclaim.

Fair Price Indicator

As described in this Twitter post, Orca instituted a novel feature called a Fair Price Indicator to automate the action that seasoned traders are accustomed to when trading on DEXes – cross-referencing token prices on centralized exchanges or price feeds.

Rather than requiring traders to manually check prices on an external venue before making a trade, Orca will notify the user if token prices vary >1% more than the price on CoinGecko. If the rate is >1% in favor of the trader, a Great Price notification will appear.

Magic Bar

Orca’s Magic Bar enables traders to seamlessly search available tokens and place orders with as few clicks as possible. This tweet includes a video showing this process.

You can type in how much of what token you want to swap, and the available pairs will show up in a drop-down menu. Rather than have multiple clicks required to initiate a swap, you must type in an order, click a button, and confirm the transaction in your wallet.

Impact Fund

On Orca’s second episode of their podcast, Yutaro and Ori go over the Impact Fund set up to bring about a tangible value to the world outside of crypto. 0.01% of all the trading fees on Orca have been donated to charitable causes through Every.org, and ORCA holders decide upon their destination.

Read this blog post for a full rundown of the ORCA token’s utility.

Next Steps

https://academy.solflare.com/guides/how-to-generate-a-wallet-with-a-recovery-phrase-desktop/

https://academy.solflare.com/guides/how-to-become-a-liquidity-provider-on-orca/