MeanFi Spotlight

MeanDAO, the organization governing Mean Protocol, recently launched its flagship product, MeanFi. With the hopes of onboarding the next generation of early adopters into crypto, Mean Protocol offers a collection of interoperable smart contracts that facilitate decentralized banking processes on Solana. The protocol aims to position MeanFi as a permissionless banking services provider, effectively bringing many of the services common to TradFi into DeFi for the first time.

One of the fundamental principles of decentralized finance is the idea of the self-custody of one’s assets. This is made possible by the power of blockchains and non-custodial wallets, which enable the user to transact and store any digital asset pseudonymously. When DeFi began taking off in mid-2020, the utility of these non-custodial wallets went through the roof as more decentralized protocols were only usable when connected to a digital wallet.

Mean Protocol and MeanFi take this utility to the next level through their non-custodial automation of advanced money streams and complex DeFi processes.

Money Streaming

Money Streaming refers to a continuous payment over a period of time. With Mean Protocol, this continuity is built into every new block. As new blocks are produced, block numbers are used to measure time which updates the balances of the parties in a contract to reflect the present value of the payments. The result is a near real-time balance update on the sender and recipient accounts. Thanks to Solana’s sub-second block time, this feels like a stream of money that flows from one end to the other.

Take, for example, Bob, who wants to send $10 to Bill over the course of 10 days. From the onset of the contract, money will be trickling out of Bob’s wallet and into Bill’s wallet at a rate of $1 per day. This provides automated and real-time value transfers and eliminates the need for a central intermediary to provide custody and fund the obligations in a payment contract.

Traditional payment structures where employers pay employees at a future date for present work have the fundamental issue of a 0% interest rate. As described in MeanFi’s Money Streaming White Paper, this financially favors the payer to the detriment of the payee. The payer could invest the money payable to the employee between the time when the work was done and when the payment was withheld. With MeanFi, the payee receives compensation linearly over time, enabling them to capitalize and utilize their incoming payments to the maximum extent possible.

Use Cases

Along with streamable one-time payments, money streams can be incorporated into various use cases across consumer and commercial banking. They will ultimately save people substantial amounts of time and money.

Payments & Payroll

The most obvious use cases for money streams are in payments and payroll practices.

Companies use complex accounting procedures to detail why the balances in their books are the way they are. When using continuous money streaming on Solana, these balances will be updated rapidly and arguably present a more accurate representation of their books than any accrual matching method could ever ascertain.

The level of automation enabled by MeanFi’s platform can drastically reduce the time, effort, and costs of any payroll and accounting division of a company.

Remittances & Allowances

Remittances and family allowances are an easy starting point to get loved ones involved in the self-custody of their assets, as funds can be regularly allocated from person to person.

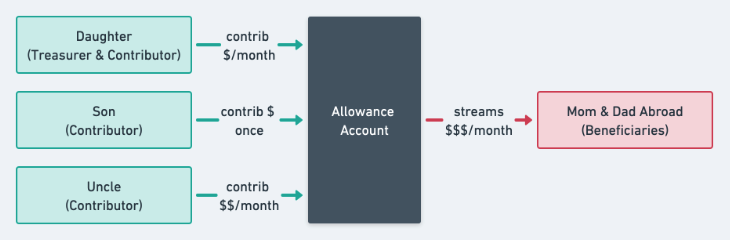

Below is a diagram from the Money Streaming White Paper that details how a remittance from children to parents could work.

Parking Meters & Upfront Subscriptions

Regarding parking, paying the absolute minimum is appealing, and continuous money streams can make that possible. As parking meters are a very short subscription to a service, it’s easy to see how money streams can enhance any subscription service.

Rather than pay for an entire month of Netflix upfront, why not pay for the service as you use it? You could earn interest on the money that will be paid later that would have otherwise had to be spent on the upfront subscription.

Dollar Cost Averaging

As noted in MeanDAO’s documentation, time in the market beats timing the market. One of the most tried and true investing methods is dollar cost averaging. This method entails consistently investing a fixed amount of money regularly, such as every week or month. While dollar cost averaging is a service offered by many centralized exchanges, these exchanges all entail counterparty risks.

It’s easy to imagine an incoming payment stream, such as monthly payroll, having a fixed percentage automatically converted into an investment as an outgoing payment stream. This automation saves users time and is an unprecedented way to expand investment time in the market.

Additional Utility

The Money Streaming White Paper also includes several other use cases, such as retirement plan distributions, real estate sales, donations, inheritances, tax payments, IPOs, IDOs, and more.

Money streaming has not been a component of traditional finance because legacy systems need to be more cost-effective and efficient to make them viable. For this reason, it’s only possible to pinpoint some of the use cases that are possible in the future. DeFi is synonymous with innovation because there is a breakneck speed at which open-source projects are iterating and improving on financial ideas.

This holds for money streaming because the best ideas for its application probably have yet to be considered.

Enhancing Traditional Financial Services

Whatever you can conceive from modern banking can be done better with a blockchain. Decentralized banking alternatives like MeanFi are introducing a new way to interact with your assets while also providing a new tool for DeFi applications to leverage.

Below is a statement from MeanDAO’s recent Medium post that succinctly sums this up.

“Completing composable workflows like “Take 20% of my salary money stream, pipe it to a lending protocol, borrow 50% of it in USDC, swap it to SOL, and stake 100% of it” are also now possible in completely automated ways thanks to Mean Protocol Money Streams.”

Enacting this strategy requires many tenuous steps that the average investor and employee would need to learn how to do or wouldn’t have time to worry about. This is one of the primary value propositions that MeanFi is offering.

Accessibility

MeanFi is currently accessible as a web three app accessible by desktop and mobile browsers through SPL-compatible wallets like Solflare. Over 60% of mobile usage is done through the Solflare wallet, and this number will likely increase with the advent of Solflare’s in-wallet browser.

Setting up incoming and outgoing payment streams is as easy as clicking a few buttons. Detailed tutorials for each of MeanFi’s services can be found here.

Jupiter’s Liquidity

To facilitate the mass migration to DeFi, MeanFi will need liquid digital markets for trades and swaps. To do so, MeanFi has partnered with Jupiter to offer best-class liquidity aggregation alongside other liquidity providers such as Serum, Orca, Raydium, Mercurial, and Saber.

Initially, MeanFi built its liquidity aggregator, but after meeting at the Breakpoint Conference, they decided to partner with Jupiter to optimize their users’ token options and experience. Jupiter will become Solana’s first liquidity aggregator to send and receive streaming payments from other protocols.

Roadmap & Community

Although MeanDAO has already come a long way, much is still to go. The team has been punctual with their product shipments, clear with their roadmap, and cultivated a cult-like fanbase through an active Discord community and Twitter following.

Q4 is turning out to be a game-changer for MeanDAO. With the launch of the MEAN token alongside official deployments of MeanFi v1 and Mean Protocol v1, December is set to become an exciting month for the MeanDAO community, and 2022 looks even better. 👀

Final Thoughts

MeanDAO is building the future of self-custody financial services in Solana. The tools being offered are just the foundation; there is so much opportunity for various applications to utilize them for different use cases. MeanFi is up and running on the world’s best-performing blockchain and is going full steam ahead. As 2021 comes to a close and 2022 begins, you can expect some big announcements from MeanFi about updates to their products and potential partnerships.