Easy Money & Veblen Goods

With a low of $0.00099 and an all-time high of $68,958.00, Bitcoin increased in value by 6,965,454,545.45% between 2010 and 2021. Just a casual 69,654,545.4545x. Hundreds of billions of dollars have been raised to support the burgeoning blockchain industry and cryptocurrencies surpassed $3.3 trillion in total market capitalization at their peak. According to Chainalysis, over $160 billion in crypto gains was realized in 2021 ($76.3b in ETH, $74.7b in BTC, and $11.7b in all altcoins). It’s easy to understand how so many millionaires and billionaires have been freshly minted during this time. All this money needs to go somewhere.

The newest money crowd wields newfound power that wasn’t possible until a few years ago as blockchains and non-custodial wallets let anyone take full control of their financial assets in an unprecedented practice known as self-custody. Assets are no longer custodied by banks or investment firms but rather they remain decentralized, on-chain assets that are globally trading in liquid markets 24 hours a day. The ability to 100x or -100% on a portfolio has never been easier.

Cryptocurrency and blockchain technology have relatively higher barriers to entry than traditional finance, which is already a convoluted subject to understand. Between developers, entrepreneurs, traders, venture capital funds, hedge funds, quantitative trading firms, and absolute beginners, there are levels of informational asymmetry that can continuously be exploited as new participants and unaudited protocols enter the market. As a result, there are always opportunities for more money to be made.

Where Will All This Money Go?

Now that it’s clear there is a lot of crypto money out there and it has to go somewhere, consider the anthropological and psychological aspects of what blockchain technologies are enabling. NFTs, DAOs, airdrops, and on-chain governance are bringing people from all over the world together to work towards similar goals or participate in incentivized networks and communities.

This, along with the newfound generational wealth results in a number of interesting behaviors between groups of strangers.

Normal Goods & Discretionary Spending

Normal goods are items that are purchased more often when incomes rise and discretionary spending refers to purchasing non-essential items.

Below are some examples of discretionary spending on normal goods.

- Buying the newest iPhone when your current one works fine.

- Buying an expensive latte machine when your drip coffee maker works fine.

- Going on vacation.

Most high-quality items are normal goods. Inferior goods on the other hand are items that you buy less of as your income rises. These are usually cheap substitutes for normal goods like knock-off clothing brands and low-quality food.

Veblen Goods, Luxury Items, & Mimetic Desire

When you get to the high end of the price spectrum on normal goods like cars, clothes, pens, watches, NFTs, etc., rules start to change. These normal goods turn into something else entirely – Veblen goods.

Veblen goods are items that get more valuable as their prices increase.

Think about the white cotton t-shirt from TJMaxx that sells for $5 and compare it to the white cotton t-shirt from Prada that sells for $500. While there may be negligible differences in material, there is the Prada insignia located somewhere on the Prada shirt. With that insignia comes clout and cultural significance. Prada stands for something cool and anyone who wears Prada is cool, right?

This type of social engineering is a large part of what drives the prices of luxury items skyward, and NFTs are a prime example. What drives people to NFTs is a long list of reasons but very often it is either for the idea of buying something for X and selling it to someone for X+Y, the idea of being and owning a part of a community, or both. So how can you value an NFT or a set of NFTs? If you ask many of the most successful traders in crypto, they would tell you to follow the cult.

Notice they aren’t recommending you join the cult, but rather you observe which communities are the most cultish in their behavior and position investments accordingly. This can be carried across cryptocurrencies and NFTs but is especially prevalent in NFTs.

NFTs are valued at whatever someone else will pay. If there are 10,000 items in a set of NFTs and 20,000 people want to own one or more of them, that creates an imbalance that can only be resolved with prices going up. People notice the price going up and they want to get in on it. This makes the price go up even more until finally there is finally a capitulation event, the average buyer is priced out, and the price starts trending down.

Mimetic desire is an interesting way to frame this dynamic.

This topic has been discussed at great length among many crypto and market publications but it’s worth diving into to give a sense of how psychological phenomenons can drive price action.

Mimetic Desire

Mimetic desire is best explained with an analogy. Imagine you are standing next to someone on a trampoline. That person sees something they want that requires them to jump in order to reach it. When they jump, you feel the movement of the trampoline underneath you. A natural reaction is to look at where this movement is coming from. When you see the thing that the person next to you wants, Mimetic theory argues that you’ll start to want that thing too.

Learn more about it here.

Baby behaviors are often used to describe the effects of mimetic desire. If you observe a room of 5 babies and 5 toys, the first baby that grabs the first toy will make that first toy an object of desire for the other 4 babies. All of a sudden, the other 4 babies will want that particular toy for themselves even though there are 4 perfectly available toys laying around the room.

Given the previous examples, the final one is ironic – markets are bastions of mimetic desire.

Why do people flock to gold when financial times get rough and when there are more rare earth metals out there? Why are people buying $3 million dollar images of cartoon apes when there are other cartoon NFTs out there?

In short, because other people are doing it.

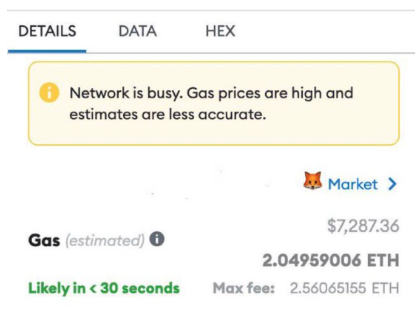

Ethereum’s Gas as a Veblen Good

One can argue that even Ethereum’s transaction fees have become a Veblen good.

Given the fact most entrants in NFTs are on average newcomers to crypto and that newcomers typically value UI/UX and low fees over decentralization, why are the most expensive NFTs on Ethereum when other chains like Avalanche and Near offer just as adequate onboarding experiences and lower fees?

An answer could be the fact that Ethereum is the original Turing-complete Infinite Machine or the idea that only people who could afford to transact on Ethereum could own Ethereum NFTs. Unless you are in it for the relative decentralization – which many are not, trading on Ethereum can now be considered a Veblen act since there are other cheaper options to deploy and purchase NFTs.

In Conclusion, It’s All Psychology

When economies bust, discretionary spending goes down. When economies boom, some normal goods transform into Veblen goods. As prices go higher, people notice. As people notice, more people buy, and prices balloon even higher – until they don’t.

If BTC is up 5%, some people will buy but many will feel like they’ll have a chance to buy at a similar price later so they don’t have to buy now. If BTC is up 20%, these same people may feel like they won’t be able to pay less than where the price is now so they buy now. The same goes for selling.

There are 2nd and 3rd order effects to every decision. Basing your trading decisions on how you perceive other people will react will place you one step ahead of the traders who are simply reacting. Then take a step back and think about basing your trading decisions on how you perceive how other people will perceive other people reacting.

Then take another step back… and another …

Micro and macro versions of this phenomenon take place at every moment in crypto’s 24/7 markets.

It’s fractal.

There is endless FOMO and endless opportunities to get rekt but there are also endless possibilities.

Solflare is here to help you through this journey by allowing you to securely open decentralized bank accounts and investment accounts – AKA blockchain wallets – on the world’s highest-performing blockchain. Solrise, our other product, is an extension of that framework where anyone in the world can open a fund and anyone in the world can Solflare is here to help you through this journey by allowing you to securely open decentralized bank accounts and investment accounts – AKA blockchain wallets – on the world’s highest performing blockchain. Solrise, our other product, is an extension of that framework where anyone in the world can open a fund and anyone in the world can invest in an on-chain fund permissionlessly invest in an on-chain fund.

Go find that easy money.