Rather than dive into an analysis of the issues with permissioned and opaque TradFi (traditional finance) systems, this chapter breaks down the role that DeFi (decentralized finance) can and does have in developed, emerging, and frontier markets.

Today’s Agenda

- Money

- Finance, and the US

- Bretton Woods

- Crypto’s Role

- Developed Markets

- Emerging and Frontier Markets

- DeFi

Money

Money as a concept is simple. It has just three value propositions.

Money’s Value Propositions

- store of value

- unit of account

- medium of exchange

An economy can function as long as it has something that serves those three purposes, but without it, there’s no choice but to resort to a barter system where goods and services are traded for goods and services. Theoretically, a barter system could work on a small scale but can’t support global trade or commerce. For the last century, the US dollar (USD) has become the standard store of value, unit of account, and medium of exchange for the whole world. Along with the world’s largest military, the status of the world reserve currency, and straw within the dollar milkshake theory, the US dollar carries a lot of baggage – mainly the American financial system.

Finance, and the US

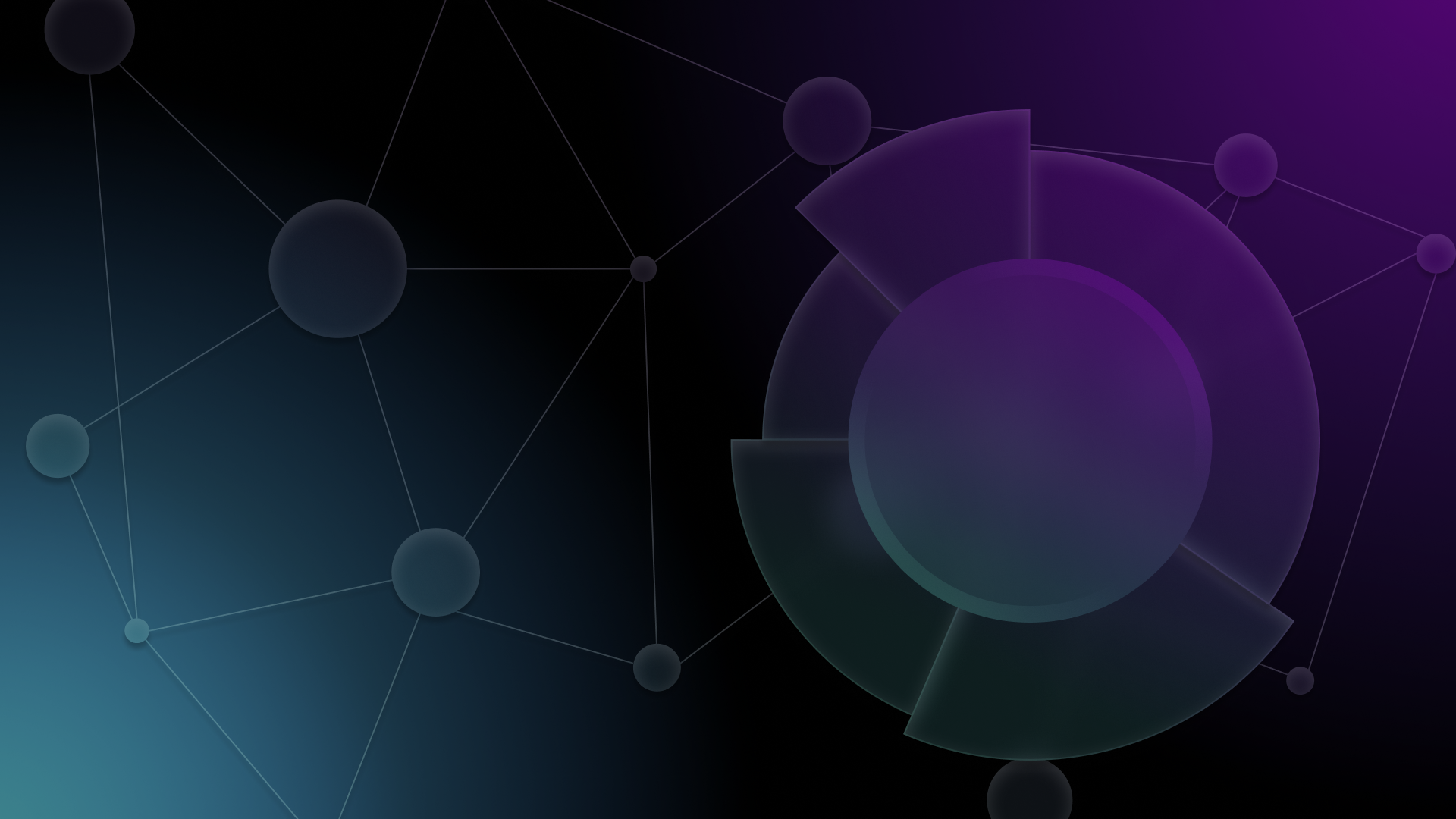

According to the IMF’s 2022 estimates, The United States GDP accounts for 24% ($25.3 trillion) of the global GDP ($104 trillion) while accounting for only 5% of its population. Considering the relative position of every other country in the world, it’s easy to understand why the US is so influential in world affairs. The US has more money to spend than any other country and has the world’s most prominent military presence backing it up.

While the US isn’t even close to being the country with the most wealth inequality, 1% still owns 30% of the wealth and 16x more than the bottom 50%.

To support the massive amount of assets within the American financial industry, there needs to be an enormous amount of infrastructure – and there is. There’s Wall Street, the Federal Reserve (12 branches), the US Treasury, the SEC, the CFTC, the ACH network, the SWIFT network, banks, credit bureaus, insurance companies, more regulatory agencies, auditing firms, securities brokers, the buy side, the sell side, short sellers, the NYSE, CBOE, CME, and more. Then there’s the human layer atop that includes the Senate Finance Committee, Federal Reserve Chairmen, bankers, accountants, auditors, RIAs, CFAs, CFPs, FRMs, CAIAs, CFOs, hedge fund managers, family offices, insurance salespeople, and the list goes on.

Behind all the acronyms is American academia. Federal employees and global news pundits will cite economic theories and papers from reputable universities written about, for example – Modern Monetary Theory (MMT) – as a basis for their policy choices. MMT includes justifications for excessive money printing, which has directly aligned with the Federal Reserve’s strategy of quantitative easing and economic stimulus packages. It is strongly contested by proponents of other economic perspectives, such as the Austrian school of economics. Finance and economics, like medicine, is a science that doesn’t require one to have a lot of knowledge to sound smart. Jargon will do just fine.

Bretton Woods

The position of the US in the global economy is only 78 years old. In 1944, the US, Canada, Australia, Japan, and several western European countries convened in Bretton Woods, New Hampshire, to configure a new monetary order. The US was far and away in a position of dominance since the European powers were fragile due to WW2 battles and bombings taking place on their soil. Representatives from around the world were consensually coerced into agreeing to the US’s pitch of how global monetary relations should function. The consequences of Bretton Woods were the beginning formation of many reconstruction efforts such as the World Bank, the International Monetary Fund (IMF), and the US dollar) becoming the de facto reserve currency for US-protected global trade.

This global world order has benefited billions but has caused adverse second-order effects. The financial markets and financial services industries were not exempt from such developments. As markets expanded, so did their opaqueness due to more financial intermediaries/middlepeople being introduced. Modern traditional financial practices are obsolete compared to the immutable transparency possible with blockchain technology today.

Benoit Mandelbrot observed that based on their relative ages, you can compare finance now to where chemistry was in the 16th century from an evolutionary perspective. Since that’s the case, financial alchemy is a portion of what goes on within traditional finance. Alchemy was the pseudoscience and speculative philosophy, the medieval forerunner to modern chemistry. In other words, some of what goes on behind the scenes are not in your best interest.

In the past 78 years, countries like the US, Germany, China, and Singapore have risen to become world powers, while many other economies have yet to fully develop. Economists often break the world into 3 parts – developed, emerging, and frontier. Crypto’s role drastically differs in each, for now.

Crypto’s Role

Developed Markets

Crypto is indeed a bet on new technologies changing the world but for some, it’s a bet on the old world breaking with no recourse. In other words, you don’t have to think the world’s financial system will crumble if you believe in crypto but more often than not, people who do think that also do believe in crypto. It’s a nuance that’s difficult to explain but makes a major difference. Suppose you peruse Twitter, Reddit, or other online threads about crypto. You’ll likely find people talking about how the USD will be debased, how BTC will become the world’s future reserve currency, or how dumb people in crypto are for thinking these things.

Gold bugs have felt this way for centuries. If you’re a gold bug in a country like Argentina or Turkey, where your domestic currency experiences hyperinflation regularly, then you’re hailed as a genius. If you’re a gold bug in the US, where you can safely store your USD in a bank controlled by arm guards, then you’re a wackadoodle. When Bitcoin hit the scene in 2008, along with the enshrined headline by a British daily that read, “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks” in Bitcoin’s Genesis Block, it made waves. This was the first asset that was effectively un-seizable (without a $5 wrench) and from its very first moment, it absorbed and created the underlying counterculture to traditional finance.

Because of the complicated nature of developed markets, developed financial systems are bureaucratic and, on the whole, challenging to change. Both the obsolete and practical assortments of systems that have been in place for decades are generally skeptical when it comes to change. It’s perfectly natural for large systems to reject change as it is essentially a threat to the market participants within the prevailing system. Unless the US financial system fails, outright alternatives like DeFi will likely remain a fringe activity for the foreseeable future. There will probably be DeFi integrations across many sectors within the US economy, but in terms of a total overhaul of the payment rails for the whole world, that’s quite the uphill battle.

Even if the dollar went to zero tomorrow, there are still trillions in American real estate, intellectual property, weapons, and physical goods that underly the US economy. These assets would still have value; they would need to be valued in a new currency.

For these reasons and many more, DeFi’s most considerable impacts will likely be felt within the emerging and frontier markets.

Emerging & Frontier Markets

While the US financial system may be slow, skeptical, or biased regarding adopting blockchain technology and decentralized finance (DeFi), emerging and frontier markets won’t have to operate with those same restrictions. It’s in these regions where DeFi is already proving its use case, although more of the world who need it is not using it. For those who do, it’s the only option to properly utilize money’s 3 value propositions.

DeFi is positioned to provide banking and investment services for those who need it most while helping emerging and frontier markets navigate global trade and commerce.

Without a stable mechanism like the USD to perform those duties, individuals and corporations are subject to volatile fluctuations of their assets and net worth, which prevent an economy from functioning correctly. According to the US Federal Reserve, the US had 22% of its adults unbanked or underbanked in 2019. That’s 63 million people in the wealthiest country in the world without access to adequate financial services. The rest of the world is even more underbanked and less financially literate.

Unbanked – Not having or never having savings, checking, or another account with a bank.

Underbanked – Having inadequate access to financial services and banking facilities.

Anyone who is unbanked or underbanked cannot partake in earning interest on deposits, investing in the stock market, paying bills online, purchasing goods or services over the internet, accessing credit, or several other valuable financial activities. Without standard banking, there is also the need to use alternative financial services like money orders and prepaid cards, which are inefficient and rack up fees.

DeFi’s Role

While banking could be a better system, no doubt using a good one gives an individual more financial freedom and ability when compared to being unbanked. The problem is that not all banks are good ones, and not all currencies reliably fulfill the three functions of money. While DeFi does seek to provide banking and investment services to its users, it does so without the need for banks or investment firms. The only way to do this is to not trust a counter-party.

Not wanting to trust a counter-party may sound counter-intuitive, but if there is no counter-party, then there is no counter-party risk. If there are no ethics, there is no misbehavior. It’s a technical philosophy embodied in the code behind decentralized systems, and it’s all possible because of the underlying consensus methods that enable blockchains to operate. Consensus methods are algorithms that an incentivized computer network uses to participate in collective transaction verification. The process of how this works varies from method to method.

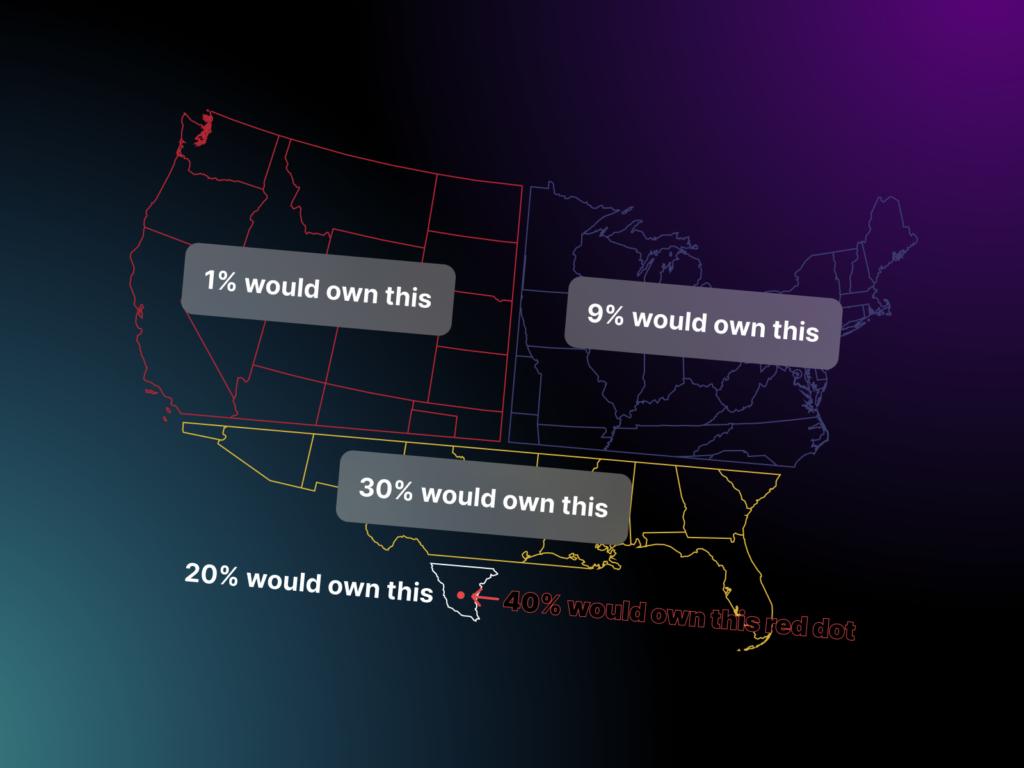

Because of immutable, interoperable, capable, and permissionless blockchains, DeFi can operate in ways that weren’t possible before. Its ambitions span that of enhancing developed financial markets and building the economic infrastructure for emerging and frontier ones. Among many goals, it seeks to onboard fiat currencies to the burgeoning digital blockchain economies through globally transferable stablecoins. Solana alone has already transferred over $300 trillion worth of value on-chain at the time of writing.

This would be a huge first step for emerging and frontier economies that deal with volatile domestic currencies and interest rates. DeFi also serves as the bedrock underpinning the NFT, DAO, and Web3 movements.

Opportunities to Enhance and Rebuild

When compared to what the established financial industries have to offer, DeFi presents alternatives that are opportunities to rebuild and enhance obsolete or convoluted processes and technologies.

While blockchain detractors claim it’s a solution looking for a problem, blockchain proponents understand that blockchains can address many real-world use cases that cannot be or have not been handled with incumbent systems.

DeFi, unlike Bitcoin, is not an argument for a new reserve currency. It’s an argument for a new form of digital commerce.