Today’s Agenda

- Financial Middle People

- An Alternative

- The FED

- FED Balance Sheet vs S&P 500

- A Condor’s View

- DeFi Doubters

- DeFi’s Use Cases Today

- Stable Coins

- Censorship Resistance

- Yield Generation

- CBDCs

At its core, blockchains are not that complicated. They’re just distributed ledgers. Distributed in the sense that there’s no single entity in control and as you may know, ledgers are nothing special – they’re just lists of transactions. The ledgers themselves are not inherently interesting but what you can do with them using a blockchain framework is game-changing.

Until Bitcoin came about in 2008, there was no alternative to the centralized, permissioned financial systems we’ve all become accustomed to. Someone stole your credit card and spent $500? Just call your bank and they can likely reverse it while issuing you a new card. In a world where the most common password is password, this level of accessibility has become a crutch. The price you pay for the convenience involved in traditional banking is having to trust banking institutions – which in emerging and frontier markets, can be troublesome.

Financial Middle People

Many banks do a great job and many bankers are nothing but ethical but behind closed doors, the world’s most prominent banks have been known to bend and break rules at will. They often get away with it because of the way that the financial system is structured and the fact that the highest-ranking officials at the most influential regulatory agencies are usually well-connected millionaires from Wall Street proves the point. The fact that no one was criminally charged for 2008’s financial meltdown and ensuing crisis while executives gave themselves bonuses with tax-funded bailouts also proves the point.

“Goldman” Gary Gensler, head of the SEC, accumulated an eye-popping nine-figure net worth prior to taking public office thanks to his multi-decade, loyal stint at Goldman Sachs. Jerome Powell, the head chairman of the US Federal Reserve, has a net worth estimated to be north of $50 million after he spent years working for various investment banks in New York City before moving on to the US Department of the Treasury in 1990. It’s not to say that all these guys do is nefarious but there are clear conflicts of interest. Their bankrolls are orders of magnitude larger than the people most influenced by their policies and this is a common issue in politics and power hierarchies.

Even if those in charge of the rules are perfectly ethical, there is still ample room for unethical behavior by middlemen -> banks, brokers, asset management firms, and any other business that requires customer deposits.

An Alternative

Blockchains offer an alternative framework in the sense that all transaction details can be made public and all protocols are open source. Previous types of financial middle people become obsolete while new types of financial middle people are required to adhere to the overarching algocratic nature of decentralized systems and their underlying consensus methods. As long as those methods are open source and verifiably accurate, then a new paradigm of transparency is possible. It may not make sense in every scenario (such as the handling of medical records) to have transactions be public but along with the immutable (non-deletable) and permissionless nature of blockchain networks, there are strong arguments for it to overhaul certain financial, gaming, academic, and archival practices (to name a few).

For more context on the financial industry, here’s a list of the number of fines that some of the biggest banks have paid since the year 2000.

- Bank of America (US) – $82,737,699,939 over 214 fines.

- JPMorgan Chase (US) – $35,744,240,670 over 158 fines

- Citigroup (US) – $25,450,155,764 over 122 fines

- Wells Fargo (US) – $21,340,036,745 over 181 fines

- Deutsche Bank (Germany) – $18,156,533,878 over 59 fines

- UBS (Switzerland) – $16,792,800,910 over 83 fines

- Goldman Sachs (US) – $16,365,468,987 over 44 fines

Not all banks are bad just as not all DeFi protocols are good. The above numbers are referenced to emphasize the truth that even the biggest and most regulated banks misbehave. They have unwieldy powers that influence every level of the economy, but of course, they are still subject to the puppet mastery of global central banks – in particular the US Federal Reserve.

The FED

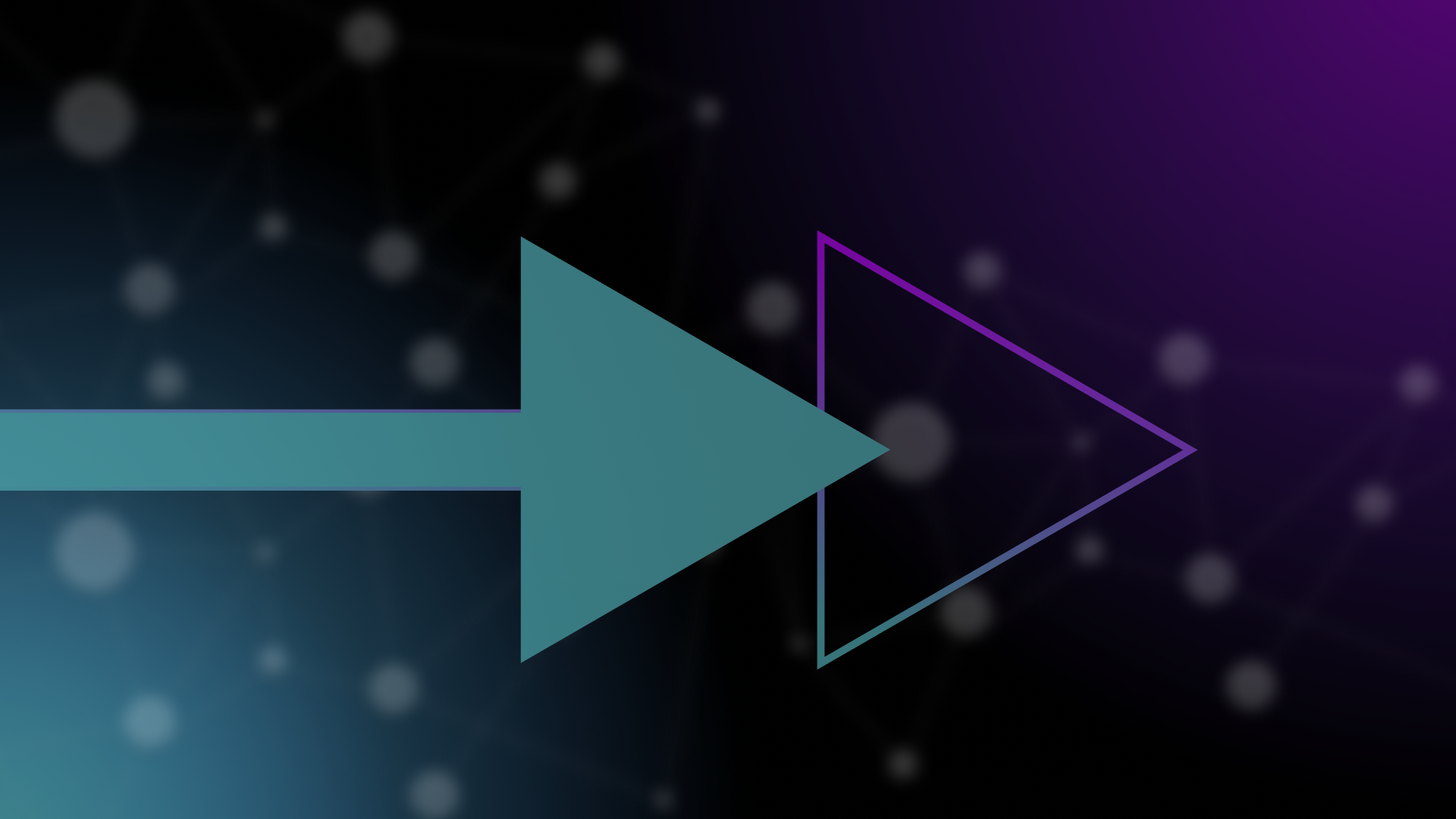

The Federal Reserve (FED) was established in 1913 as the third central banking system in the United States. From 1907 to 1910, there were severe public panics that led to bank runs. Bank runs occur when more people want to withdraw from a bank than a bank can handle. The possibility of this event is a result of fractional reserve lending which enables banks to only hold a portion of your deposit on hand while they lend the rest out to other customers.

Today’s Agenda

- Financial Middle People

- An Alternative

- The FED

- FED Balance Sheet vs. S&P 500

- A Condor’s View

- DeFi Doubters

- DeFi’s Use Cases Today

- Stable Coins

- Censorship Resistance

- Yield Generation

- CBDCs

At its core, blockchains are not that complicated. They’re just distributed ledgers. Distributed in the sense that there’s no single entity in control, and as you may know, ledgers are nothing special – they’re just lists of transactions. The ledgers are not inherently exciting but what you can do with them using a blockchain framework is game-changing.

Until Bitcoin came about in 2008, there was no alternative to the centralized, permissioned financial systems we’ve all become accustomed to. Someone stole your credit card and spent $500? Call your bank, and they can likely reverse it while issuing you a new card. In a world where the most common password is password, this level of accessibility has become a crutch. The price you pay for the convenience involved in traditional banking is having to trust banking institutions – which can be troublesome in emerging and frontier markets.

Financial Middle People

Many banks do a great job, and many bankers are ethical, but behind closed doors, the world’s most prominent banks have been known to bend and break the rules at will. They often get away with it because of how the financial system is structured. The fact that the highest-ranking officials at the most influential regulatory agencies are usually well-connected millionaires from Wall Street proves the point. The fact that no one was criminally charged for 2008’s financial meltdown and ensuing crisis while executives gave themselves bonuses with tax-funded bailouts proves the point.

“Goldman” Gary Gensler, head of the SEC, accumulated an eye-popping nine-figure net worth before taking public office thanks to his multi-decade, loyal stint at Goldman Sachs. Jerome Powell, the head chairman of the US Federal Reserve, has a net worth estimated to be about $50 million after working for various investment banks in New York City before moving on to the US Department of the Treasury in 1990. It’s not to say that all these guys do is nefarious, but there are apparent conflicts of interest. Their bankrolls are orders of magnitude larger than those most influenced by their policies, a common issue in politics and power hierarchies.

Even if those in charge of the rules are perfectly ethical, there is still ample room for unethical behavior by mediators -> banks, brokers, asset management firms, and any other business that requires customer deposits.

An Alternative

Blockchains offer an alternative framework in that all transaction details can be made public, and all protocols are open source. Previous types of financial middle people become obsolete. In contrast, new types of financial middle people must adhere to the overarching algocratic nature of decentralized systems and their underlying consensus methods. As long as those methods are open source and verifiably accurate, a new paradigm of transparency is possible. It may make sense in some scenarios (such as handling medical records) to have transactions be public. Still, along with the immutable (non-deletable) and permissionless nature of blockchain networks, there are strong arguments for it to overhaul certain financial, gaming, academic, and archival practices (to name a few).

For more context on the financial industry, here’s a list of the fines some of the biggest banks have paid since 2000.

- Bank of America (US) – $82,737,699,939 over 214 fines.

- JPMorgan Chase (US) – $35,744,240,670 over 158 fines

- Citigroup (US) – $25,450,155,764 over 122 fines

- Wells Fargo (US) – $21,340,036,745 over 181 fines

- Deutsche Bank (Germany) – $18,156,533,878 over 59 fines

- UBS (Switzerland) – $16,792,800,910 over 83 fines

- Goldman Sachs (US) – $16,365,468,987 over 44 fines

Not all banks are bad, just as not all DeFi protocols are good. The above numbers are referenced to emphasize the truth that even the biggest and most regulated banks misbehave. They have unwieldy powers that influence every level of the economy. However, of course, they are still subject to the puppet mastery of global central banks – particularly the US Federal Reserve.

The FED

The Federal Reserve (FED) was established in 1913 as the third central banking system in the United States. From 1907 to 1910, severe public panics led to bank runs. Bank runs occur when more people want to withdraw from a bank than a bank can handle. The possibility of this event results from fractional reserve lending, which enables banks to only hold a portion of your deposit on hand. At the same time, they lend the rest out to other customers.

In 1910, after helping bail out a particularly bad bank run, Chase Bank’s founder, J.P Morgan, and other high-ranking bankers secretly secluded themselves for 10 days to figure out how they could enhance the American banking system. This plan came to fruition 3 years later in the form of the Federal Reserve, a singular central bank for the USA. The FED can be considered a hybrid or different faction within the US government. It’s part of the US governmental purview, but it doesn’t necessarily have to listen to congress. Congress enacts fiscal policy, such as raising and lowering tax rates, while central banks, like the FED, enact monetary policy, such as raising and lowering interest rates. The two are often in cahoots.

As the US gained a larger share of global dominance after the two World Wars, the FED’s macroeconomic role only gained prominence. Since the chart-breaking inflation metrics of the 1970s, the FED has generally enacted an expansionary monetary policy (in contrast to a contractionary one) in the form of lowering interest rates. Think about interest rates as the cost of borrowing money. Dropping them effectively lets individuals and businesses take more risks. As interest rates have declined, even to the negative in many parts of the world, asset prices have skyrocketed. This is because businesses can borrow more money, invest in more projects, and say their future value will be even higher. For more context, stock markets are valued on future cash flows.

There are also the topics of quantitative easing, dollar dominance, and Bretton Woods that would need to be taken into account, but they could each be a course within themselves.

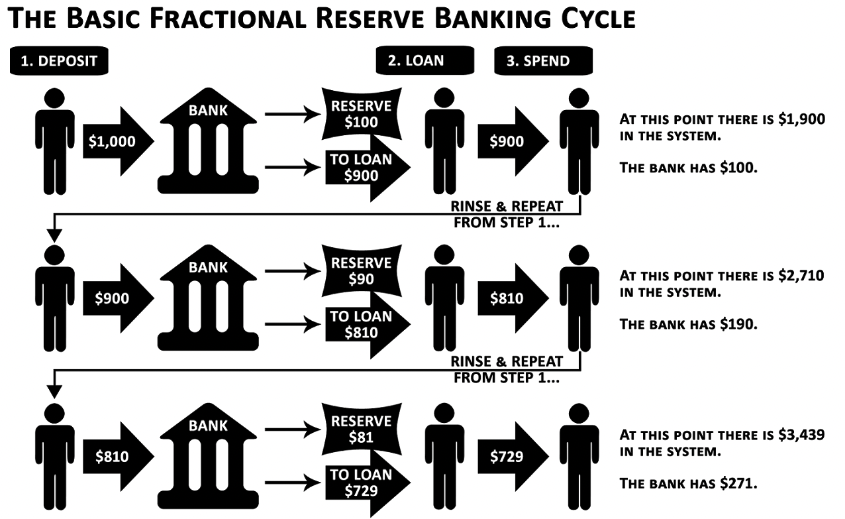

Fed Balance Sheet vs. S&P 500

Many compare inflated asset prices worldwide to the FED’s balance sheet. Let’s look at the difference between dollars put into circulation by the FED and the S&P 500, a well-rounded index of some of America’s largest public companies.

To add to the above comparison, the correlation between dollars put into circulation by the FED and the S/P 500’s price was 0.92 between April 2020’s crash and 2021’s all-time high.

A Condor’s View

Now that we’ve largely covered what’s fundamentally and technically possible with DeFi and discussed some of the underpinnings of the world’s financial system let’s view it all from a high-flying bird’s eye view. Condors fly 15,000 feet high. Let’s go with a Condor’s view.

DeFi Doubters

“The test of a first-rate intelligence is the ability to simultaneously hold two opposed ideas in mind and still retain the ability to function.”

F. Scott Fitzgerald

There are generally 2 types of DeFi doubters:

- Those who need help in understanding the tech and discount it with a misled opinion.

- Those who understand the tech but don’t appreciate the societal and economic impacts that decentralization has to offer.

A more thoughtful approach to crypto and DeFi is to be skeptically optimistic. With any new technology, there will be disruption, and not all of it will always be good. The primary problem in blockchain-related technology is that most people need help understanding it.

It’s easy to get scammed when you don’t know what you’re doing, and it’s easy to trust a snake oil salesperson if you think they know what they’re talking about. As is the case with the medical and scientific fields, it doesn’t take a lot of knowledge in crypto to sound like you know what you’re talking about. Until the average user learns what they need to know or until crypto applications’ UI/UX flows reinforce all they need to know in their users’ mindsets, crypto will remain a wild west to the uninformed.

While it’s better to be an optimistic skeptic, it’s all well and good to be a DeFi Doubter, but what’s the alternative? A continuation of opaque market procedures, unsustainable monetary policy, and hyper-inflationary events of debased fiat currencies becoming the norm?

The world is trending in a populist, deglobalizing direction, likely bringing about continued fiscal and monetary looseness. The plan is to tame inflation (9.1% in the US as of June 2022) by increasing interest rates over the next few years. As an asset class, Crypto has never experienced a prolonged environment of rising interest rates, so it will be interesting to see how prices react. However, there is a solid case to be made that interest rates will stay elevated for a while.

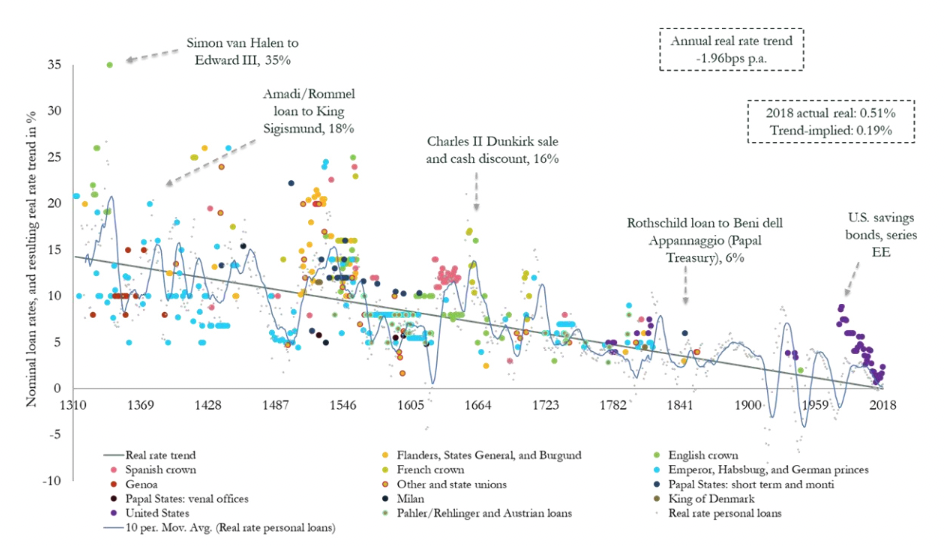

Below is a chart of the last 700 years of interest rates across the globe.

As the US proceeds to decouple itself from its previous role of international protector and, in some cases – aggressor in exchange for a more isolationist position, free global trade will struggle to sustain the exponential growth it’s experienced over the past 50-70 years. Alongside broken supply chains, uprising political conflicts, and currency debasements, politicians and central bankers will have no choice but to enact a populist fiscal policy (low taxes & high spending) and a liberal monetary policy (low-interest rates & potentially quantitative easing & yield curve control).

All of this means that fiat money will continue to devalue over time. For now, USD is accruing more value as the world outside of the US struggles to find or create worthy alternatives, but is that sustainable?

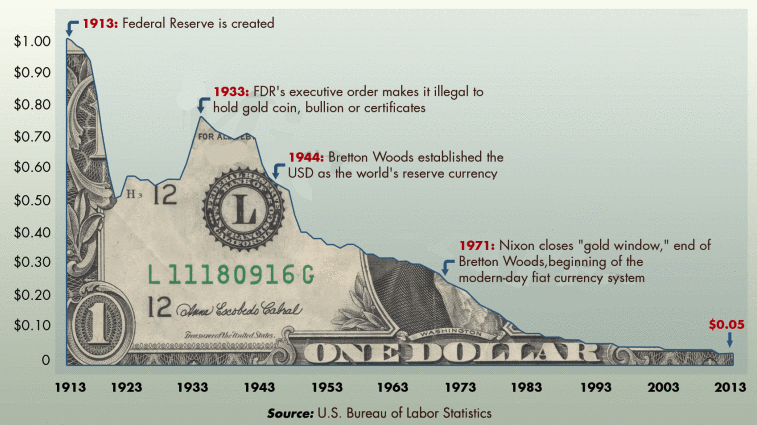

The chart below shows how much the value of $1 has declined from 1913 to 2013.

TL;DR In today’s terms, $1 in 1900 was equivalent to $26.14 in 2020, implying a decrease in buying power of 96.2%. Remember, when assets go down 90+% in value, that never means they can’t do the same thing again.

So, where does DeFi come in? It varies. If you’re in one of the wealthier countries in the world, you may utilize DeFi as an alternative investment class. Still, for those in less financially secure countries, you may be using DeFi because you don’t have any other option.

DeFi’s Use Cases Today

Stable Coins

Let’s say you’re living in Turkey. The Turkish Lira experienced a reported 78% inflation from 2021-2022. So your $100 worth of TRL is roughly $22 if the bank gives you back your deposit. This type of heartache used to be unavoidable for the global middle and lower classes, but now there’s an alternative.

Instead of using a soon-to-be-defunct domestic bank in a country with a falling currency, you can open a non-custodial wallet like Solflare and securely store an infinite amount of digital assets. This wallet isn’t physical. You can bring it across borders by remembering your recovery phrase or keeping a copy of your private key. Operational security risks and other nuances need to be considered, but this example gives you an idea of what’s possible.

How easy is it to withdraw $25,000 from your bank? How easy is it to travel across violent borders with that $25,000 – especially if that $25,000 worth of value is in another currency other than the USD. The answers are all that it is exceedingly difficult to do so without DeFi.

Censorship Resistance

Real estate debt levels and nationalized industry have taken a toll on the Chinese banking system, and some banks have already censored withdrawals. Chinese authorities recently switched some citizen health codes from Covid negative to positive (which effectively banned them from all public venues and transport systems) to prevent them from withdrawing from their bank. In May of 2022, it was reported that nearly 1 million Chinese customers were unable to withdraw money from bank accounts.

Then tanks were deployed on the protesters who had their funds frozen.

Regarding centralization and censorship, China is extreme, but the world operates on a spectrum.

The need for DeFi also operates on that spectrum.

Yield Generation

Crypto has been iterating on its forms of yield generation for some time. Some of it is a positive byproduct of the tools used within DeFi, and some of the more centralized versions of it, like Celsius, are nothing but loosely regulated, falsely marketed, over-leveraged degeneracy. Using liquidity pools is one example of genuine yield generation that cuts out the middle man and gives regular people a chance to profit from their digital assets. For a complete primer on them, check out the article below.

Traditional financial markets require market makers. Market makers are specialized traders who provide liquidity to a market. There are good and bad effects, side effects, and second-order effects resulting from this infrastructure, and one of the outcomes is the vast majority of traders lose money.

Through the use of precise algorithms, Automated Market Makers (AMMs) effectively replace market makers for both volatile assets (ETH for BTC or ETH for USD) and stable assets (USDC for USDT or ETH for wETH). As described in Chapter 3, AMMs are algorithms programmed atop a blockchain that let you trade one digital asset for another using a pool of funds and a pricing mechanism. Liquidity providers are usually paid in one of two ways – with a share of the trading fees or an incentivized liquidity allocation. Incentivized liquidity allocations (liquidity mining campaigns) are unsustainable but extending a percentage of trading fees to liquidity providers is not.

Below is a list of the top 5 7-Day Average Fees metrics DEXes across various blockchains.

The fee model for nearly all these DEXes is a variation of “Trading fees are paid by traders to liquidity providers.” This is a prime example of democratized access to a yield that was gaited and exclusively available to market makers in a TradFi framework. Utilizing AMMs also makes financial services more transparent as the entire convoluted trade life cycle is simplified as it’s all settled on a public blockchain.

No more payment for order flow!

Ryan Selkis, the CEO of Messari, recently published a thread of “35” use cases for which you can use DeFi. It’s worth a scroll.

Privacy & Encryption & CBDCs

If you don’t believe that privacy and encryption are human rights, then you’ll love Central Bank Digital Currencies (CBDCs). They let governments have an insight into every transaction, and they would ultimately have control over every one of their citizen’s balances. Nearly all central banks are looking into issuing their own CBDCs, and several nations, like Nigeria, have already done so. The full scope of CBDCs and their impact likely will be understood once their widespread adoption has taken effect.

All of this ties into the more extensive arguments surrounding encryption and privacy. It’s a nuanced topic and if you haven’t started going down that rabbit hole, below is a video of Tim Cook, the CEO of Apple, arguing for privacy’s importance in light of authorities trying to hack into an iPhone to obtain details regarding terrorist attacks.

Moving On

There is plenty more to talk about concerning all the moving parts and issues involved with DeFi, but this course is just a 101. Having gotten this far in the system, you’ll now have an adequate enough understanding to venture into the real world. The next chapter will give you all the resources you need to onboard to DeFi and start self-custodying your assets.