How to Trade Perps on Mango

If you want to trade perpetual futures on a decentralized exchange, Mango Markets is a great option.

It’s a round-the-clock permission-less derivative exchange that offers margin trading, lending, borrowing, and more. This guide focuses on perpetual futures trading.

What is a perpetual futures contract, otherwise known as a perp? Read this article to find out.

Step 1

- Go to Mango.Markets and click Start Trading on the top right of the screen.

Step 2

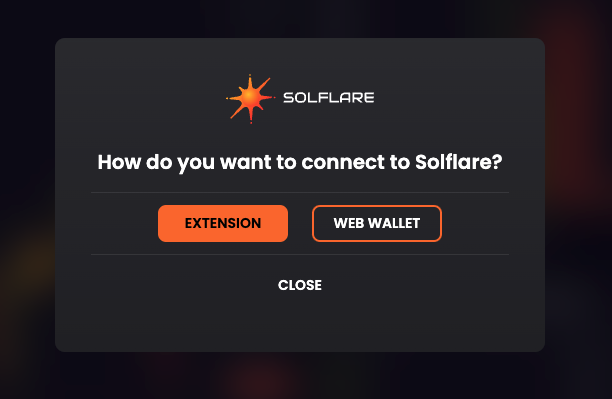

- Click Connect Your Wallet in the top right corner of this screen and then choose which way you would like to access your wallet.

If you haven’t already installed the browser extension, you can do so here.

Step 3

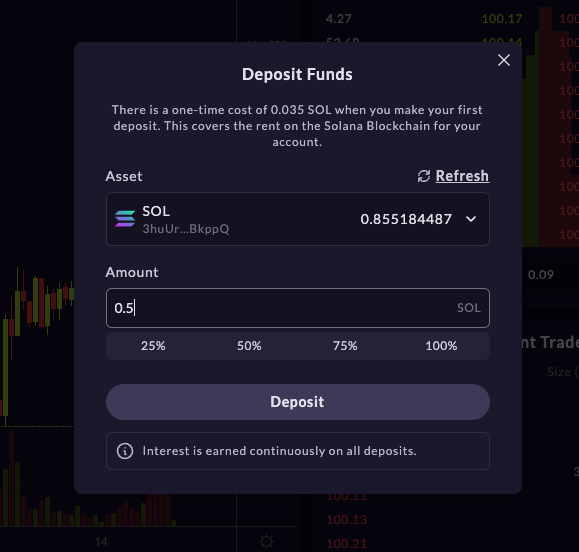

- The first thing you have to do is deposit collateral onto the platform.

- There is a one-time fee of 0.035 SOL when you make your first deposit.

Side note – interest is earned on all deposits!

Step 4

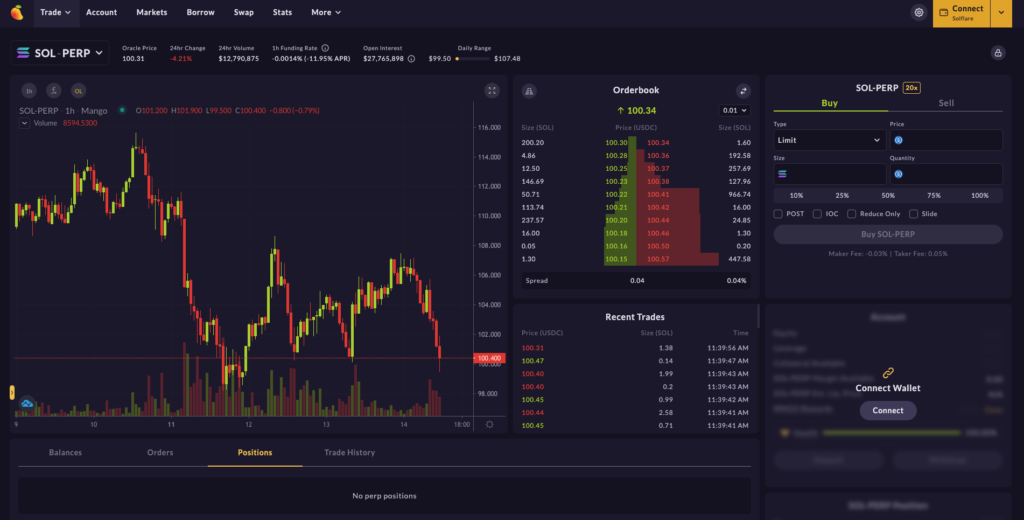

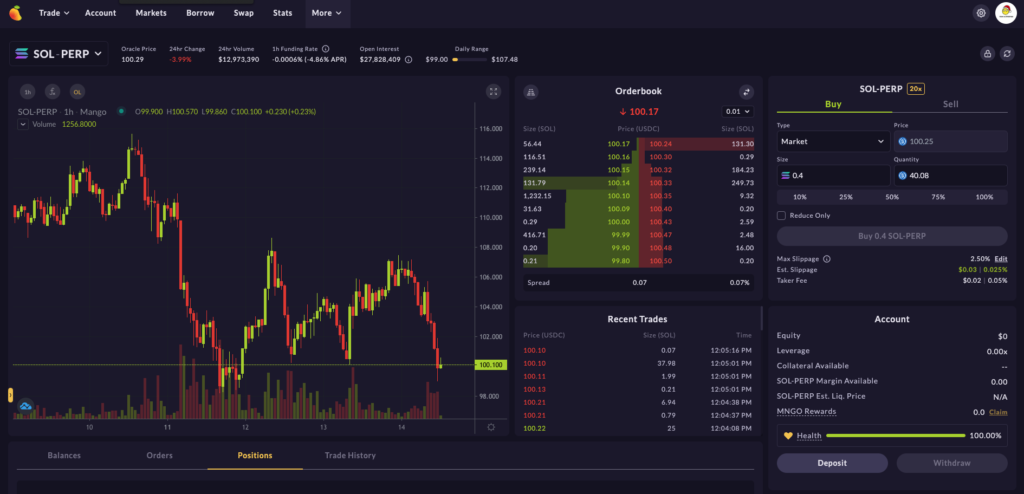

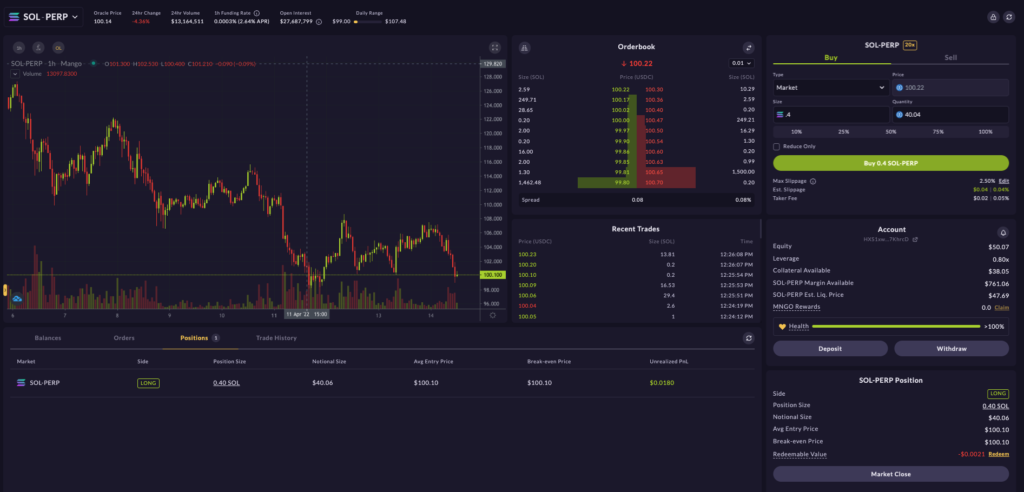

- Place your order.

The box on the top right of the page is where you can configure the details of any of the following orders:

- Limit

- Market

- Stop Loss

- Stop Limit

- Take Profit

- Take Profit Limit

For a better understanding of what these orders are, check out this page in Solrise’s Gitbook.

You can choose to size your trades in either the cryptocurrency you’re trading or USDC.

Step 5

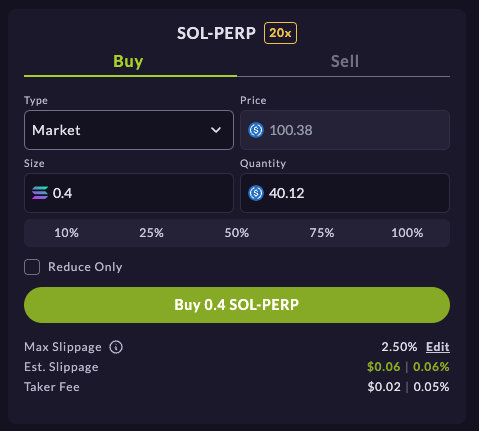

- Within that same order box from Step 4, place your order by clicking, in this case, Buy 0.4 SOL-PERP.

You can adjust your slippage before placing the order if desired.

Step 6

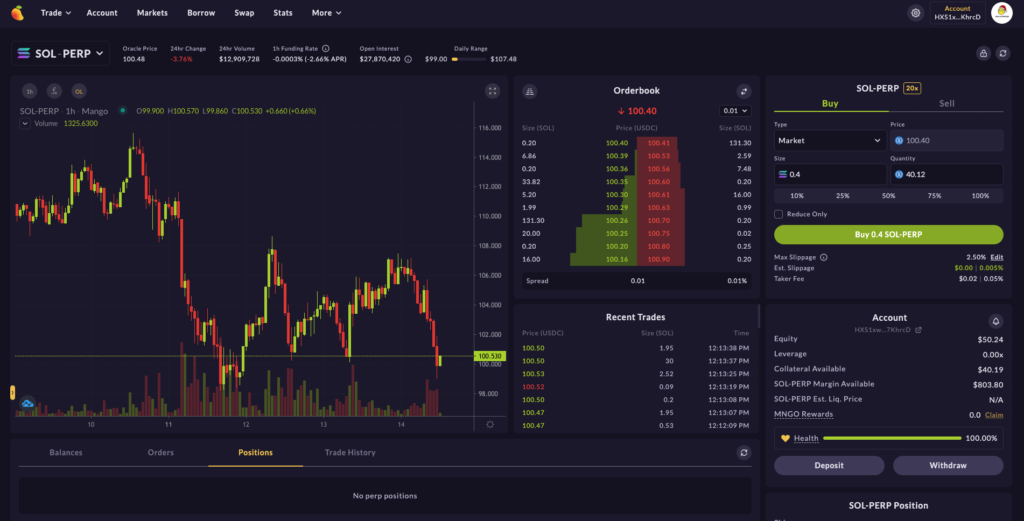

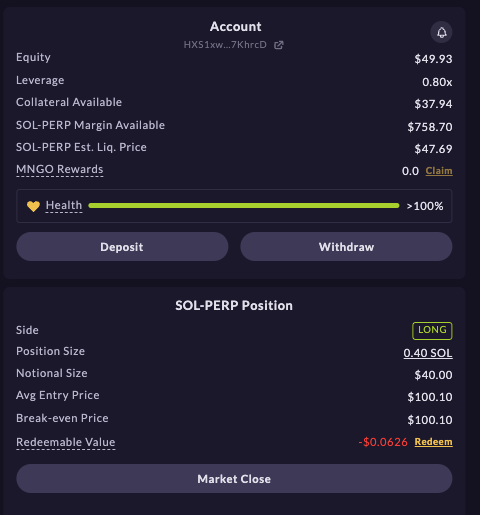

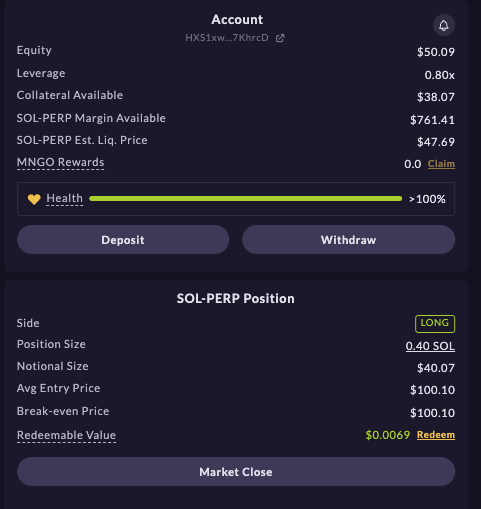

- Monitor your position.

Once your order is confirmed, you’ll see the live P/L as well as your leverage ratio, any MNGO rewards you are able to claim, and more.

These boxes are located underneath the TraderView chart.

Step 7

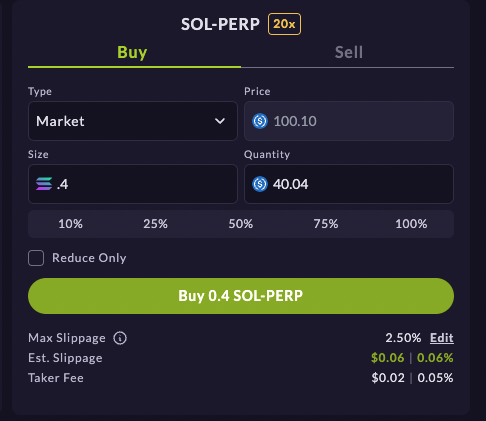

- To close your position, you can either set a limit order, a take-profit order, or a stop-loss order.

In this case, let’s click Market Close to get out of the position immediately.

Step 8

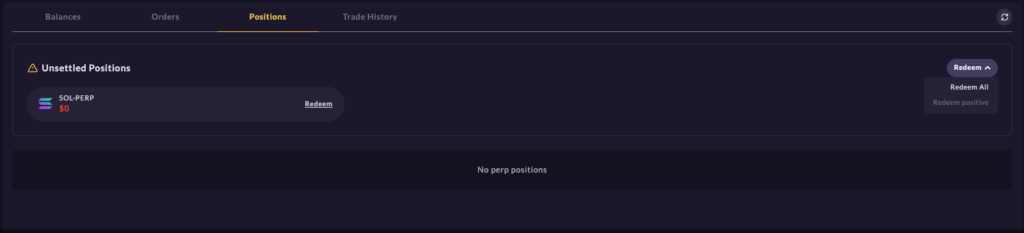

- Redeem any profits or losses from your trade.

Since there was a profit or a loss (in this case, a loss) when the transaction settled, you will have to redeem the balance in the positions tab under the TraderView chart.

All Done

You’ve now successfully completed a leveraged trade of a derivative of a digital asset on-chain!

If you don’t trust yourself to leverage long or short the market, you may be interested in investing in one of Solrise’s decentralized funds as managers have access to trading on Mango as well.

The synergy between Solflare and Solrise is obvious, as in the near future Solrise funds will be directly exposed to Solflare’s huge user base. Solflare users will have the possibility to invest with one click directly from the app.

Exciting things to come!