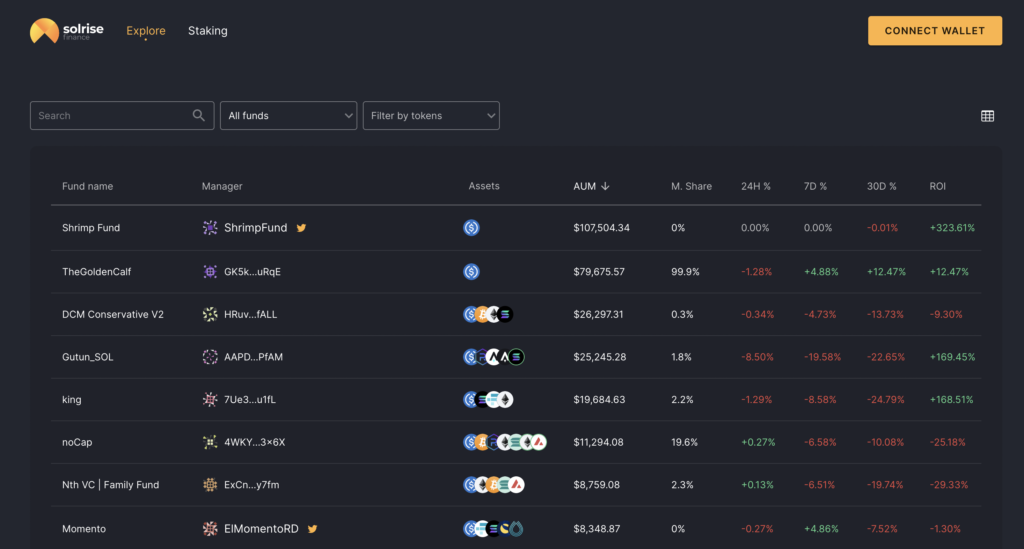

How to Create a Solrise Fund

Step 1

- Go to Solrise.Finance and click Launch App.

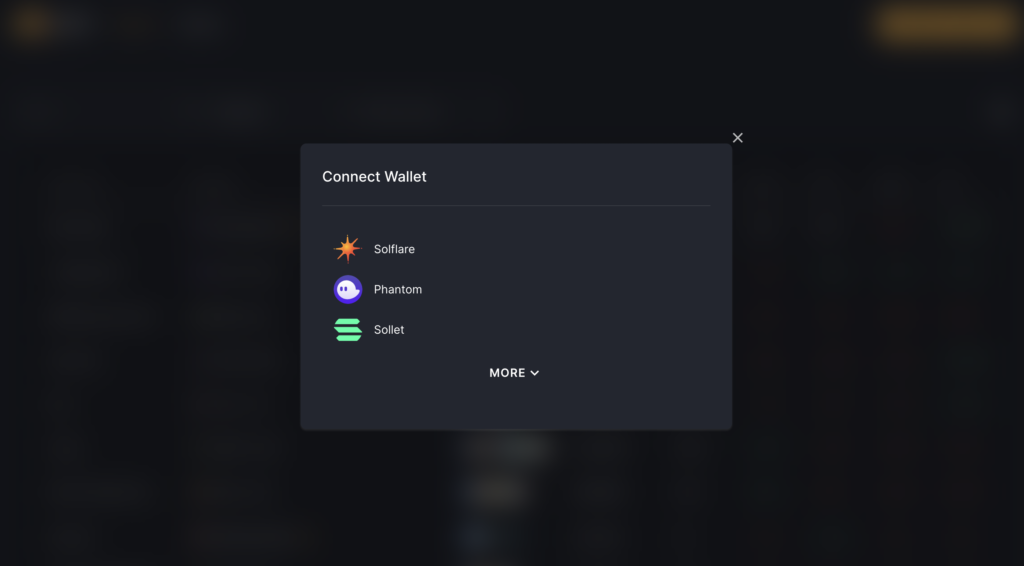

- Click Connect Wallet in the top right corner and then click Solflare.

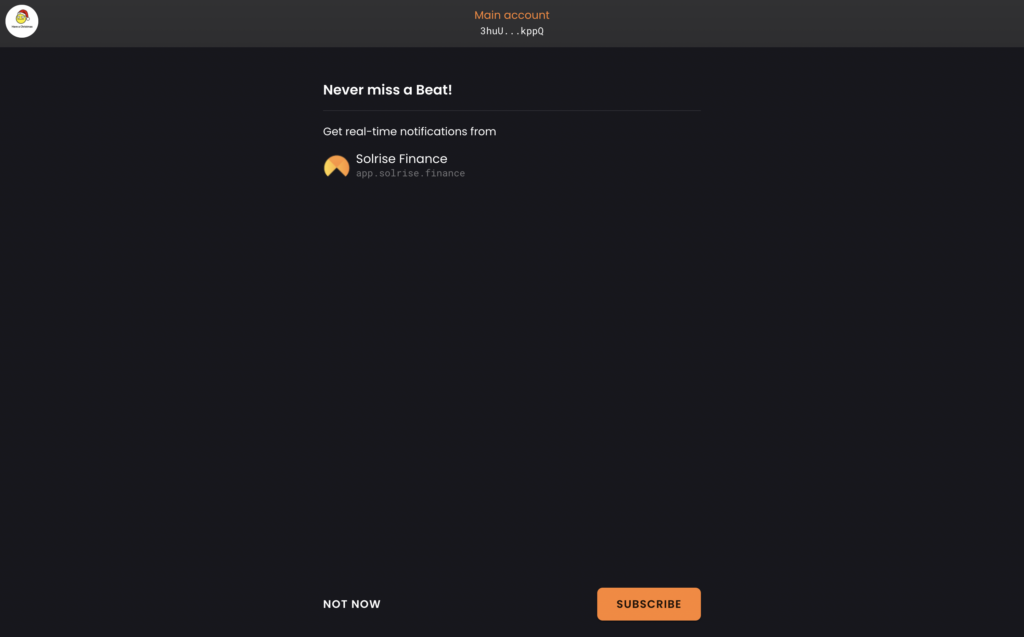

Once you’re logged in, you can subscribe to real-time browser notifications.

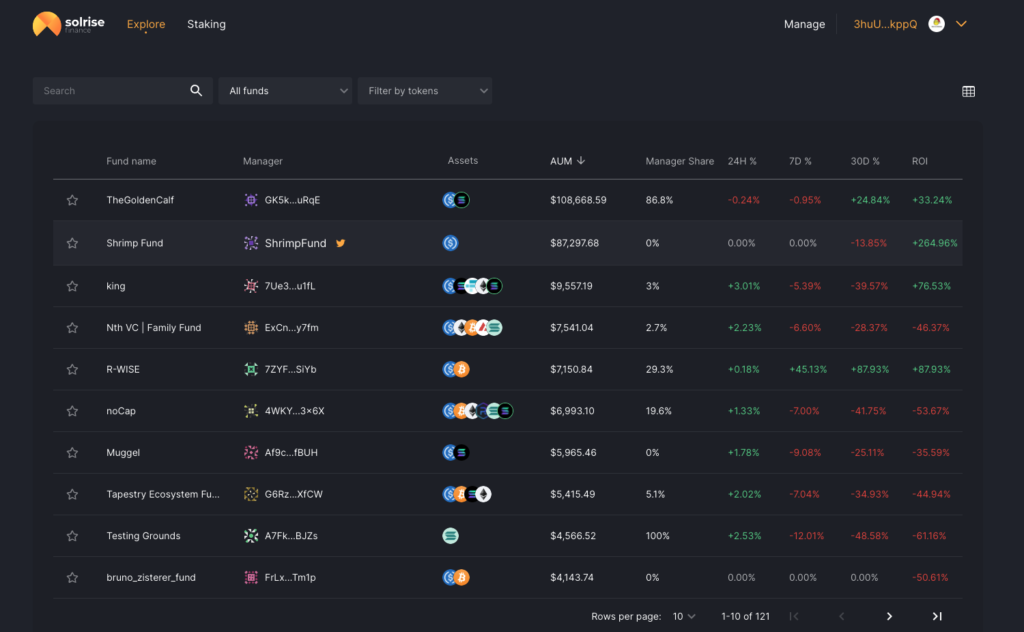

Step 2

- You’ll be automatically taken to the Explore page. Click Manage on the top right.

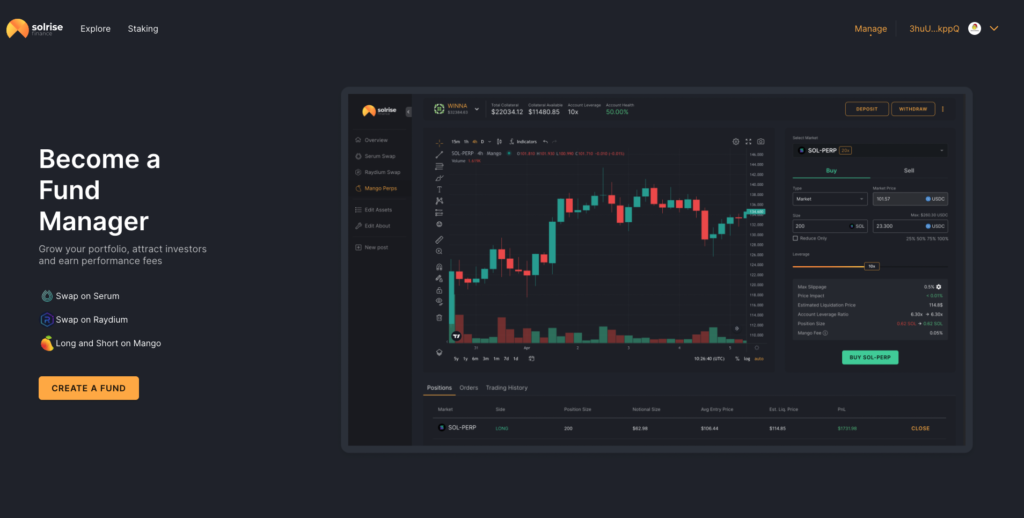

- Click Create a Fund.

You’ll need to have at least $1 USDC in your wallet to create a fund.

Step 3

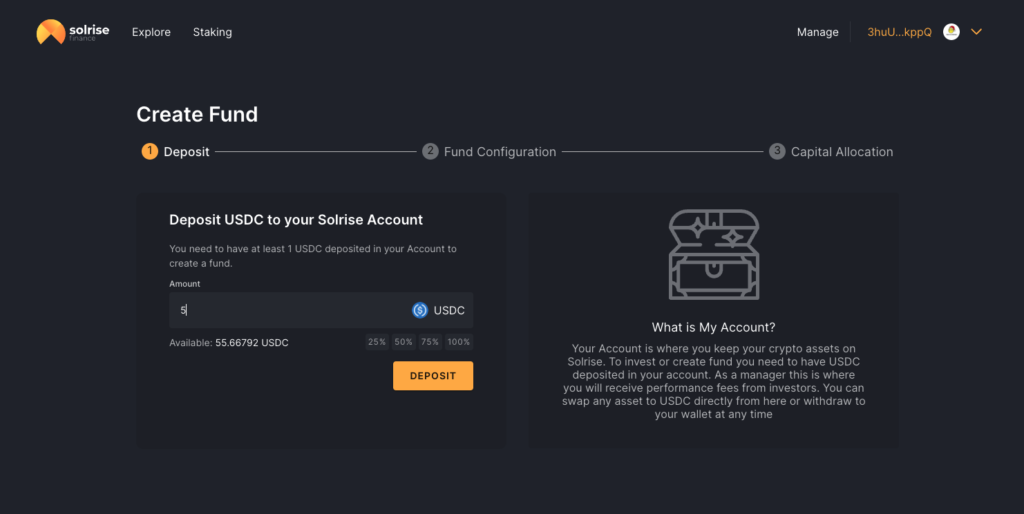

- Deposit the amount of USDC you’re going to invest into your fund (+1 USDC for fund creation) and click Deposit.

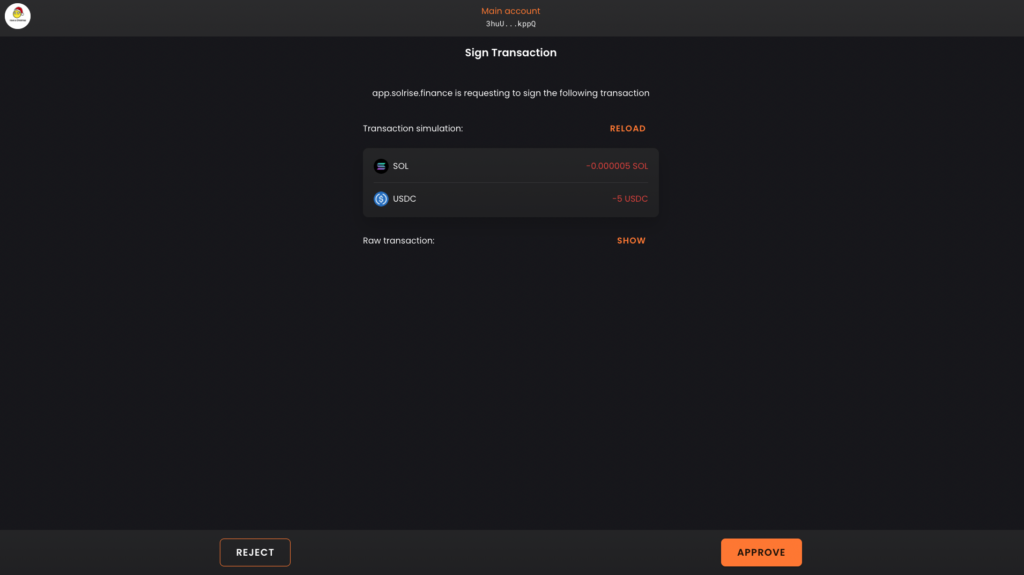

- Approve the transaction.

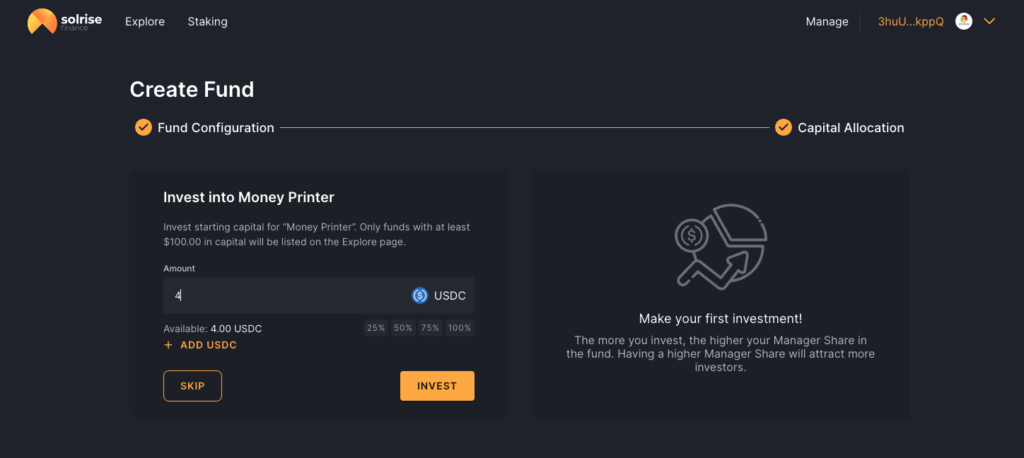

There is no minimum manager investment but funds with less than $100 AUM will not be included on the explore page.

A large investment made by a manager into their own fund signals that their incentives are aligned with their investors and are likely to attract more investor attention. If the manager makes money, the investor will too – and vice versa. Each investor in a fund owns a % of the fund based on the size of their investment so there’s no gaming which money is actively managed or not.

In order to gain the highest possible amount of investor trust, it’s recommended that managers invest in themselves as much as possible.

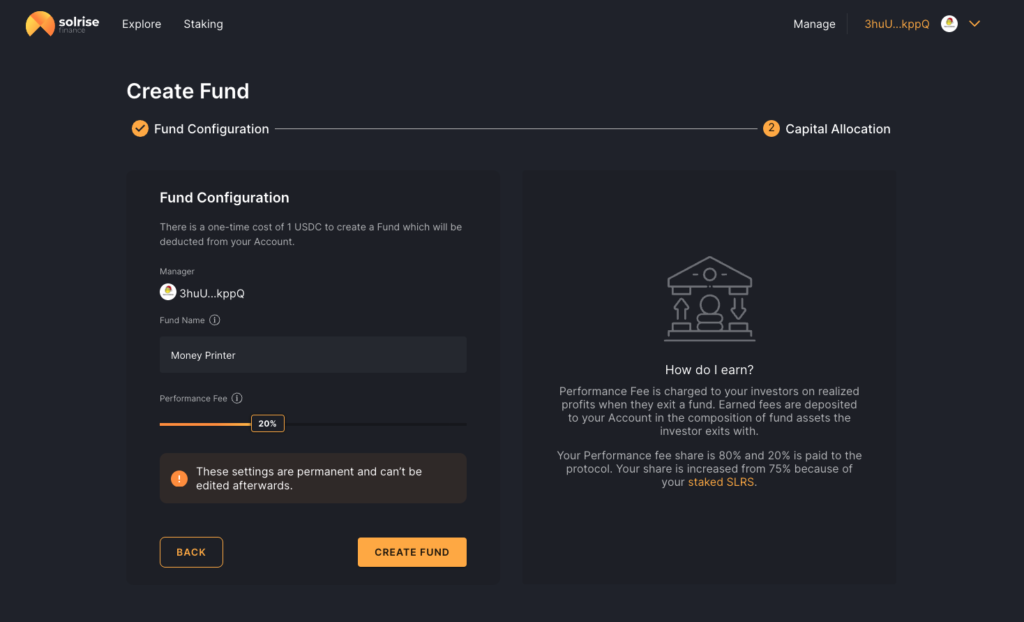

Step 4

- Configure your fund by naming it and assigning a performance fee.

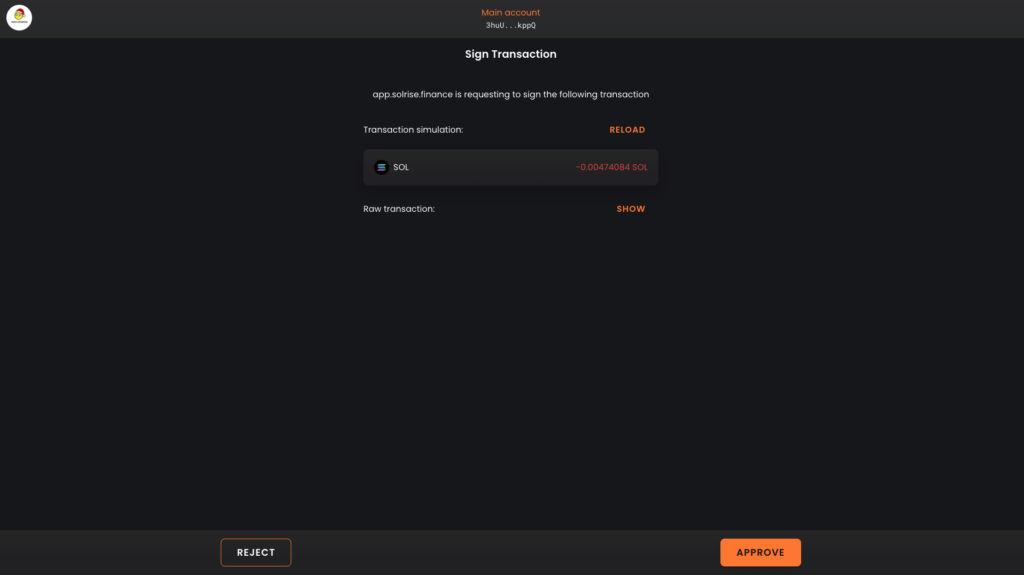

- Approve the transaction.

The utility benefits of staking SLRS differ depending on which market participant you are.

- As a Manager, you get a higher share of the performance fee that investors pay to withdraw from a fund.

- As an Investor, you pay lower exit fees to the Solrise protocol when you exit a fund.

- As a Solflare User, you pay lower in-app swap fees.

- As an SLRS Staker, you have exposure to 8-40% APYs depending on how long the stake is locked up for.

The full benefits of staking SLRS are described here.

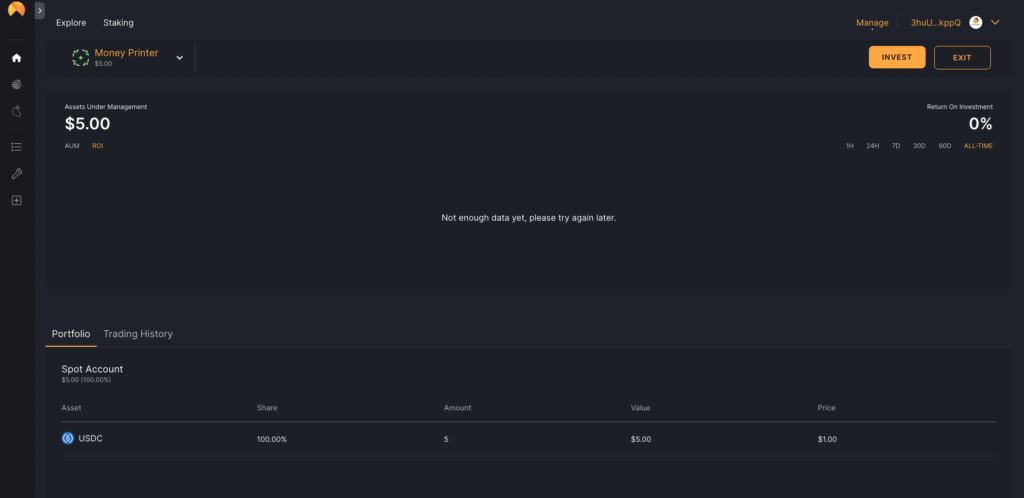

Step 5

- Invest in your fund with the USDC you deposited into your manager account earlier.

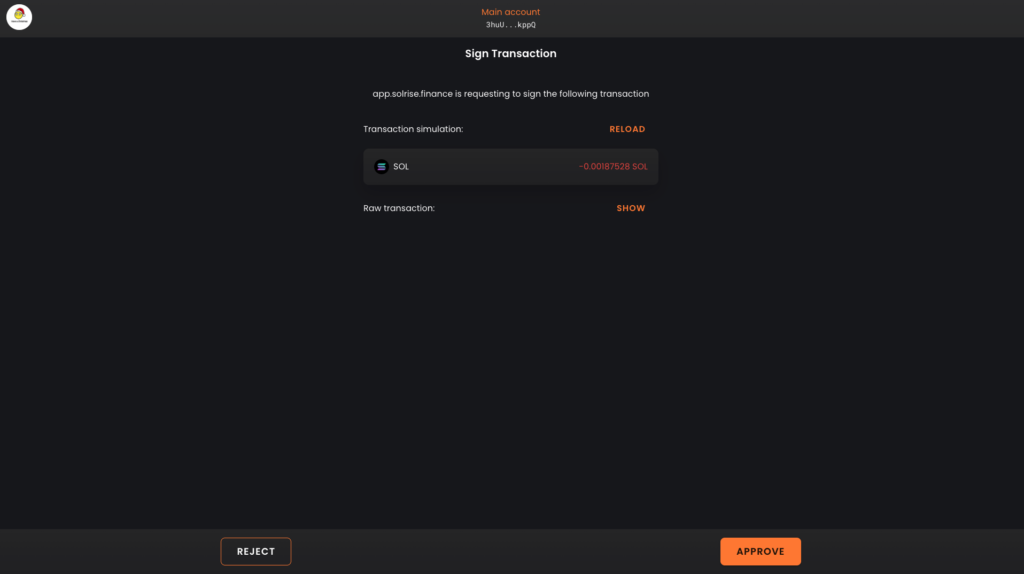

- Approve the transaction.

It’s that easy!

You can now access and manage your on-chain, permissionless, 24/7 crypto fund directly from the manager page. Solana’s low fees and quick transaction speeds are an ideal environment for traders and asset managers. For reference – 1,000,000 trades on Solana costs about $10.

Solrise recently integrated Mango Markets and Jupiter’s DEX Aggregator directly into the platform. You can long or short perpetual futures on Mango on a range of assets and you can be sure that you’re getting the best swap prices using Jupiter.

Keep an eye out for future integrations that you can take advantage of as a digital asset manager.